Advertisement

Advertisement

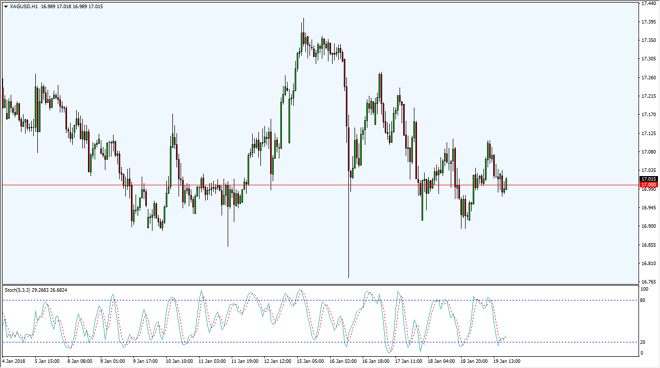

Silver Price Forecast January 22, 2018, Technical Analysis

Updated: Jan 20, 2018, 07:10 GMT+00:00

Silver markets were noisy during the day on Friday, initially tried to rally, but then pulled back to the $17 level, which has been acting as a magnet for this market lately. Because of this, I think it’s essentially a “50-50” market, and therefore difficult to trade.

Silver markets fell after initially trying to rally during the day on Friday, and settled near the $17 level. The market looks very likely to continue to be noisy around this area, and because of this I think that short-term Silver traders are going to have to be thinking of scalps more than anything else. Currently, looks as if the $17.10 level is offering short-term resistance, while the $16.90 level is offering support. Because of that, it looks to me as if scalping back and forth is probably about as good as it gets.

Pay attention to the US dollar, specifically the US Dollar Index, as if it starts to fall again, that will give us a bit of a boost in the silver market. The US dollar is starting to strengthen a bit, and that may put a bit of a damper on silver in the short term. However, longer-term it certainly looks as if the US dollar has a lot of issues. It is because of this that I prefer to buy physical silver more than anything else, but I do recognize that CFD markets might be able to be used. Futures markets can be far too volatile and dangerous to be trading right now, as we will see a lot of choppiness the next several sessions. If you are cautious, you can take advantage of this later, but right now you’re probably best playing this market with a light touch, waiting for clarity.

SILVER Video 22.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement