Advertisement

Advertisement

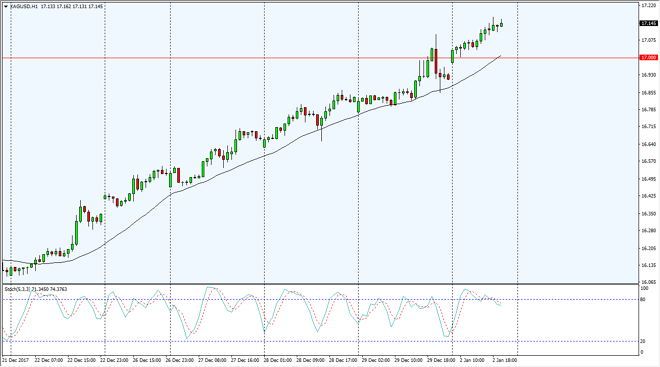

Silver Price Forecast January 3, 2018, Technical Analysis

Updated: Jan 3, 2018, 07:11 GMT+00:00

Silver markets rallied a bit during the trading session on Tuesday, gapping at the open, and then breaking above the $17 level. I think that the market could pull back slightly, perhaps offering the opportunity to pick up a bit of value. I think that the $17 level should now offer at least a minor support level.

Silver markets gapped higher at the open on Tuesday, clearing the $17 level rather handily. The Silver markets have been very strong as of late, and of course the US dollar has been softening. As the US dollar weakens, it’s likely precious metals will rally, silver of course included. I think that the market will go looking towards the $17.50 level next, and then eventually the $18 level.

Buying pullbacks could be a good way to find value, and with the volatility that we see in the Silver markets typically, it’s probably better to look for those pullbacks to get involved and perhaps add to a longer-term position. I don’t have any interest in shorting silver, at least not anytime soon as the 24-hour moving average has been so reliable and so bullish. That moving average is at the $17 level, so there are a couple of different reasons to think that it will continue to find buyers.

Longer-term, I believe that Silver markets not only reach the $18 level, but breakout above there and continue the longer-term. Silver markets have been grinding higher for some time now, and a relatively slow manner. Because of this, I believe that the market is one that you must think of more as a possible investment opportunity, as the market has been more of a steady climb than anything else. By adding slowly, you can build a large position of the next several months.

SILVER Video 03.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement