Advertisement

Advertisement

Silver Price Forecast January 8, 2018, Technical Analysis

Updated: Jan 6, 2018, 05:47 GMT+00:00

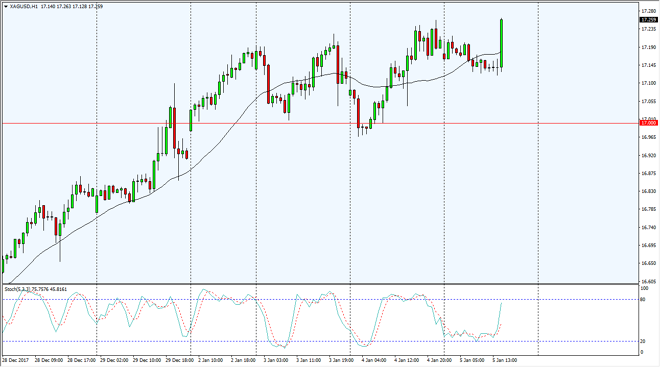

Silver markets went sideways during the session on Friday initially, waiting for the jobs number to come out before making the move. You can see that we have exploded to the upside, and it’s likely that we are going to eventually go much higher.

Silver markets initially drifted sideways and quiet trading, awaiting the Nonfarm Payroll announcements come out. Now that we had formed this bullish candle, it’s likely that we will continue to go higher, perhaps reaching towards the $17.50 level above. Short-term pullbacks will more than likely offer buying opportunities, and I think that we will eventually go much higher. I think the $17 level should be an area that buyers will be attracted to based upon value, and the fact that it has offered support several times. This is basically a reaction in a “anti-dollar” theme, as precious metals have been working to the upside as the US dollar has been falling.

The gap just below the $17 level also offers a significant amount of support, so keep this in mind when trading this market. I believe that $17 is going to be very difficult to break through to the downside, and therefore these dips should offer plenty of opportunities to add to a position and build it up over time. If we can break out to the upside, I think that $18 will be targeted, followed by $20. These are long-term calls obviously, but in the meantime, this is a great type of market to start building a huge position. I think that the selling of silver won’t be able to be done until we get below the $16.80 level, which would be a major breakdown at this point. If that happens, I would anticipate that the US dollar should skyrocket in the Forex markets.

SILVER Video 08.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement