Advertisement

Advertisement

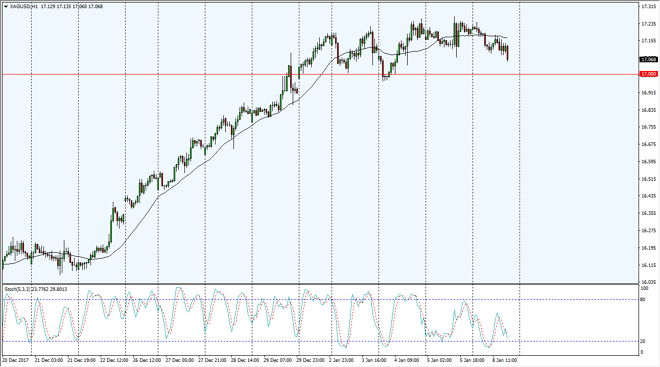

Silver Price Forecast January 9, 2018, Technical Analysis

Updated: Jan 9, 2018, 03:13 GMT+00:00

Silver markets drifted a bit lower during the trading session on Monday, which is not a surprise considering that the US dollar has rallied. The $17 level underneath is a significant level, and is likely to be an area where the buyers could return.

Silver markets rolled over during the trading session on Monday as the US dollar gained in strength. It might be a bit of a short-term phenomenon though, as the $17 level should offer support. I believe that this market is eventually going to find reasons to go higher, as a break above the $17 level was of course important. Even if we break down below there, there is a gap that extends down to the $16.90 level, so it’s not until we break down below there that I am concerned about the bullishness of silver. I suspect that at the first sign of a bounce, traders will come back in and push silver towards the $17.25 level above, which has been resistance. I think given enough time, we will break above there and go looking towards the $17.50 level. Longer-term, I think we go even farther, perhaps to the $18 level and beyond. I believe in the strength of silver longer-term, but I also recognize that Silver markets have been extraordinarily choppy for some time, and even with the recent bullishness, that shouldn’t change massively.

If we did breakdown, I think we will find support at $16.50, and most certainly at the $16 handle. Longer-term, I do like the idea of owning silver, but I think taking it slowly is probably the only way to go, as the volatility will of course offer many problems going forward. The marketplace continues to offer value on these dips, and that’s exactly how you should be paying attention to it.

SILVER Video 09.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement