Advertisement

Advertisement

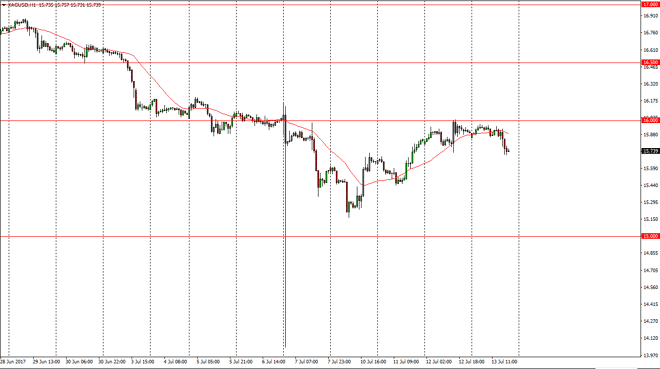

Silver Price Forecast July 14, 2017, Technical Analysis

Updated: Jul 14, 2017, 05:29 GMT+00:00

Silver markets continue to grind sideways just underneath the $16 level. Because of this, the market looks as if it is ready to roll over though, as even

Silver markets continue to grind sideways just underneath the $16 level. Because of this, the market looks as if it is ready to roll over though, as even with the impressive moved to the upside, the $16 level continues to be massively resistive. We have broken down below the uptrend line on the hourly chart, and because of this I feel that the market is going to continue to go much lower, perhaps the $15.50 level, and then the $15 level after that. I recognize the psychological significance of the $15 level, so it would not surprise me at all to see that hold as support for a while. Because of this, the market looks likely to continue to be volatile, but with a negative attitude.

Selling rallies

In the short term, I will be selling rallies as I believe the market will continue to roll over. If we do breakdown below the $15 level, the market should go much lower, perhaps even as low as $10 over the next several months. In the meantime, I think that we will continue to see the volatility pick up in this market as there has been so much strength in the US dollar, and quite frankly was central bank’s around the world raising interest rates, it’s difficult to imagine that precious metals will do well without some type of massive number of geopolitical headwinds entering the economic situation, or perhaps even some type of military action. Because of this, the market looks likely to be noisy, but I think will continue to see bearish pressure unless something drastic happens. I am a seller rallies, but recognize that we will see choppiness, so I believe that short-term trading will continue to be the general attitude of this market.

SILVER Video 14.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement