Advertisement

Advertisement

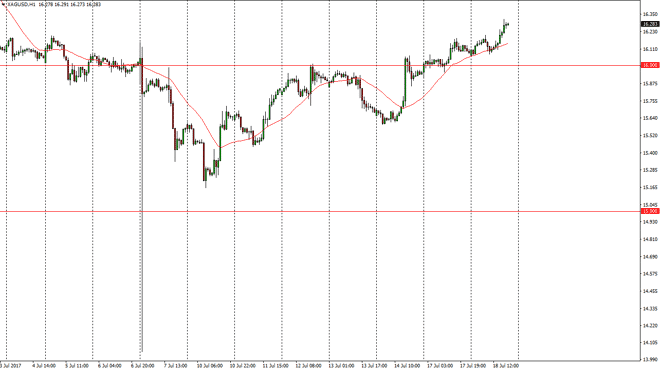

Silver Price Forecast July 19, 2017, Technical Analysis

Updated: Jul 19, 2017, 05:58 GMT+00:00

The Silver markets went to the upside during the session on Tuesday, as in the $16 level has offered support. I believe that the market should continue to

The Silver markets went to the upside during the session on Tuesday, as in the $16 level has offered support. I believe that the market should continue to go higher, perhaps reaching towards the $16.50 level, as the US dollar continues to get hit overall. I believe that the market should continue to be a “buy on the dips” situation, and I believe that as long as we can stay above the $16 level, the market should continue to find plenty of bullish pressure. I believe that the US dollar will continue to get pummeled, and that perhaps the $15 level was going to be the “floor” in the market. The market should continue to find both leveraged and unleveraged buyers, as the market continues to offer a safe haven from the US dollar.

Buying dips

I continue to buy dips, and I have no interest in shorting. I do not think that the market will eventually break down anytime soon, and I believe that longer-term we’re going to go looking for the $18 level, and then eventually the $20 level after that. I am very bullish of silver, least until we get some type of inflationary pressure in the United States, which seems to be dissipating.

SILVER Video 19.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement