Advertisement

Advertisement

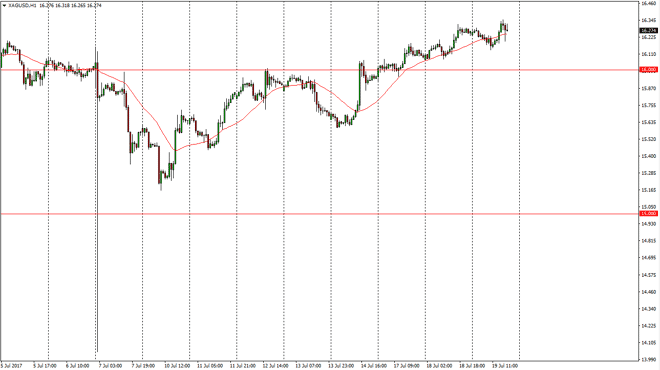

Silver Price Forecast July 20, 2017, Technical Analysis

Updated: Jul 20, 2017, 06:22 GMT+00:00

Silver markets initially fell on Wednesday, but found enough support near the $16.20 level to turn around and break out to the upside. It looks likely

Silver markets initially fell on Wednesday, but found enough support near the $16.20 level to turn around and break out to the upside. It looks likely that we will continue to reach towards the $16.50 level, an area that will attract a lot of attention. I believe that the market has a bit of a “floor” in it near the $16 level, and as a result I think that any move towards that area will have a lot of buying pressure into the market. A breakdown below there would of course be very negative, but I doubt that’s going to happen anytime soon. Quite frankly, I’m very interested in buying silver, but I recognize that this is more of an investment instead of some type of short-term trade. Short-term traders will be using a lot of leverage, I will be forgoing most leverage, and buying silver in physical bits as I believe we will go looking towards $20 over the next several months.

Buying dips, buying often

I am buying dips in silver, and I am buying often. The difference is I am buying it in small increments and that is going to be crucial. That way, I can hang on through the almost certain volatility that we will continue to see. Nonetheless, as we continue to see buyers jumping into the market, I think that we will have plenty of opportunities for pullbacks to offer the value necessary to trade this market, so therefore that’s exactly what I am looking to do. Slow and steady wins the race, and slow and steady is exactly how I think most profitable traders will be looking at this market over the next several months. As the US dollar loses some of its luster, Silver will start to shine.

SILVER Video 20.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement