Advertisement

Advertisement

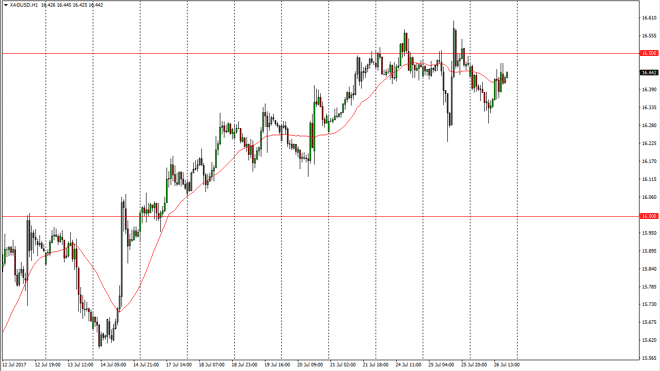

Silver Price Forecast July 27, 2017, Technical Analysis

Updated: Jul 27, 2017, 04:41 GMT+00:00

Silver markets continue to jump around during the Wednesday session, as the $16.50 level has offered a bit of resistance. If we can break above the $16.60

Silver markets continue to jump around during the Wednesday session, as the $16.50 level has offered a bit of resistance. If we can break above the $16.60 level, I feel at that point that Silver can continue to go much higher, perhaps reaching towards the $17 level, and even beyond that. I do believe in the longer-term viability of silver as most of you know, but obviously there are quite a few headwinds and noises out there that cannot the market about. Low leveraged positions I think are still preferred, and to the upside. I like buying physical silver, but I recognize that it is much easier to pick up ETF such as the SLV, or even a CFD trade in the silver market. I have no interest in shorting silver, least not until we break well below the $16 level, but even then I think that there is a significant amount of a floor at the $15 level. Either way, I expect to see a significant amount of volatility.

Short-term choppiness, long-term bullishness.

I think that longer-term bullishness would continue to be the underlying tone of the market, and that’s exactly why I want to take most of the leverage out of the trade. This allows you to eventually find the profits that could happen with the longer-term though, and I believe that adding to your position in small increments as it works out in your favor is probably the way to go. It’s going to be very difficult to deal with the choppiness, but I also recognize that if you can be patient and add slowly, this allows you to stay in the long game, which I do think is higher pricing for precious metals overall, silver of course reacting similarly to gold.

SILVER Video 27.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement