Advertisement

Advertisement

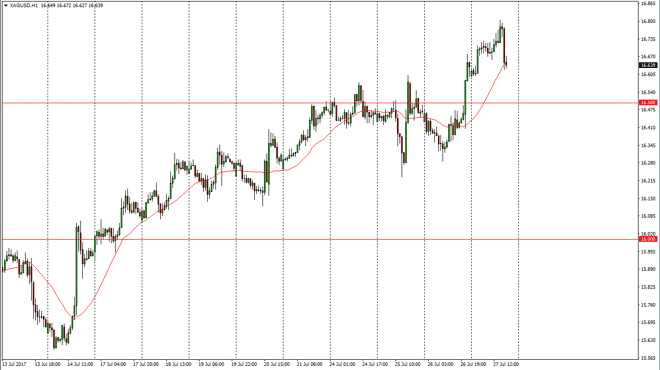

Silver Price Forecast July 28, 2017, Technical Analysis

Updated: Jul 28, 2017, 04:57 GMT+00:00

Silver markets rolled over after initially tried to rally on Thursday. By doing so, it looks as if we’re going to test the breakout, to see if there is

Silver markets rolled over after initially tried to rally on Thursday. By doing so, it looks as if we’re going to test the breakout, to see if there is support there. If we can bounce from just below current levels, the market could find itself reaching towards the $17 level. I believe that the market should continue to favor silver overall, as although the US dollar has seen a bit of a resurgence during the day, this is a bit of a relief rally more than anything else. I believe that the $16.50 level below should be supportive, so a bounce or a supportive candle from the general vicinity could be a nice buying opportunity. I believe that the market will then go hunting for the $17 level but obviously Silver will continue to be volatile as it typically is anyway. We had gotten towards a bit of an overextension by the bullish traders out there, so a pullback makes sense as there is a bit of profit-taking.

Looking for supportive candles

I’m not interested in selling silver, I think we are far too well supported underneath. I’m looking for supportive candles to start taking advantage of the overall uptrend that we have seen for several months, and then would be aiming for at least $17 above. Looking at longer-term charts, I think that it is also likely that we not only reach $17, but break higher to the $18 level after that as it is a much more important and interesting level on the longer-term charts. I have no interest in selling silver, least not yet. I believe that the market would have to break below the $16 level for the floodgates the open so to speak, so until then I am patiently waiting for a buying opportunity.

SILVER Video 28.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement