Advertisement

Advertisement

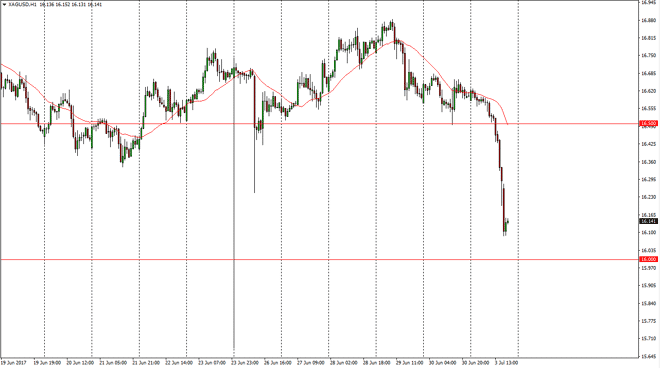

Silver Price Forecast July 4, 2017, Technical Analysis

Updated: Jul 4, 2017, 04:44 GMT+00:00

Silver markets fell slightly during the day on Monday, and then accelerated once the Americans came into play. Breaking below the $16.50 level was

Silver markets fell slightly during the day on Monday, and then accelerated once the Americans came into play. Breaking below the $16.50 level was negative, and the $16 level underneath being targeted now looks to be supportive. I think that the breakdown has been a sign that the sellers are getting more aggressive, and of course the US dollar strengthening during the session on Monday works against the value of precious metals. I think that any rally will have to deal with the $16.50 level above, which should now be massively resistive, not to mention the fact that there is a 24-hour exponential moving average that has been somewhat influential. Precious metals obviously are highly influenced by the US dollar, and if it continues to rise, I think that continues to punish precious metals.

Breaking down below $16?

If we break down below the $16 level, the market should continue to go much lower, perhaps reaching down to the $15 level. That of course is a psychologically important level, and it’s likely that the massive amount of support underneath that keeps the uptrend intact. If we can break down below there, the whole things can a full apart, and then the market goes to the $12 level after that. I think that the market will offer significant amounts of volatility that traders will have to deal with. Remember, Silver tends to be even more volatile than gold, and that should continue to be the case in the short term. It looks as if rallies should be selling opportunities, and the $16 level giving way will be even more bearish. If we did somehow break above the $16.50 level above, the market should then go to the $17 level above which has been important as well.

SILVER Video 04.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement