Advertisement

Advertisement

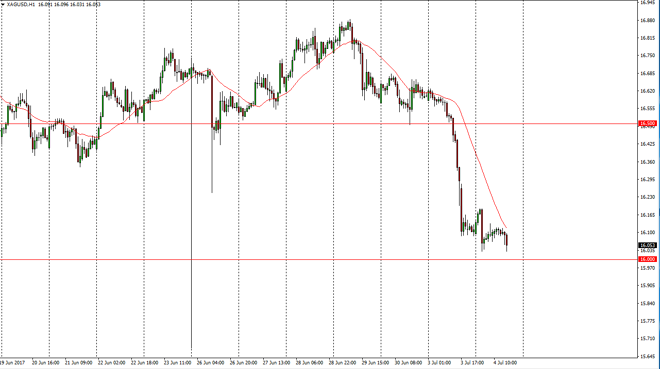

Silver Price Forecast July 5, 2017, Technical Analysis

Updated: Jul 5, 2017, 04:52 GMT+00:00

The Silver markets fell slightly during the day on Tuesday, as liquidity would have been an issue. After all, the United States was celebrating

The Silver markets fell slightly during the day on Tuesday, as liquidity would have been an issue. After all, the United States was celebrating Independence Day, and that of course will have major players out of the market. Nonetheless, this is a market that continues to look very soft, and with central banks around the world looking to tighten interest rates, this will continue to work against precious metals, and I believe it’s only a matter of time before a breakdown. If we go below the $16 level, it’s likely that the market will go looking for the next psychological support level at the $15 level. At this point, I believe that rallies will continue to be selling opportunities on signs of exhaustion, as the markets look likely to try to rebound from this area, but in the end, I don’t think there is going to be a reason to turn things around.

FOMC Meeting Minutes

The FOMC Meeting Minutes coming out during the session should give an idea as to how hawkish the central bank is going to be going forward. If we go more hawkish, it’s likely that the central banks will continue to bring up the value of the US dollar, which of course works against the precious metals in general. Rally should be selling opportunities, and it’s not until we break above the $16.50 level that I would be convinced of a move to the upside. Look for reasons to sell, either breakdown or exhaustion, and although I believe that given enough time Silver will rebound and continue to the upside longer-term, I believe that at this point the only way you can own Silver is to buy physical coins and bars. Physical is the only way to go.

SILVER Video 05.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement