Advertisement

Advertisement

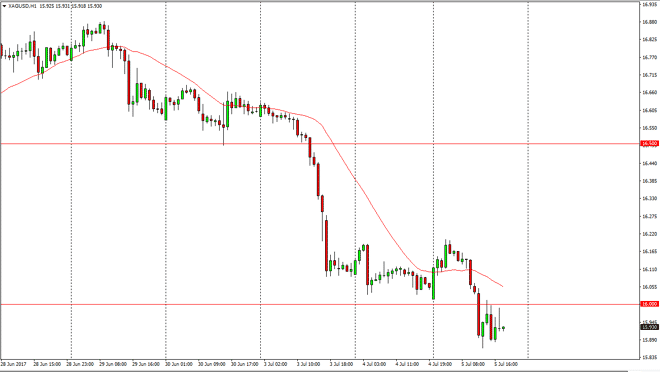

Silver Price Forecast July 6, 2017, Technical Analysis

Updated: Jul 6, 2017, 05:02 GMT+00:00

The silver market went sideways initially on Wednesday, and then broke down below the $16 level. That level is supportive, but now that we are broken down

The silver market went sideways initially on Wednesday, and then broke down below the $16 level. That level is supportive, but now that we are broken down below there, the market bounced a bit to test the level for resistance. So far, we have found it, and it looks as if the market is going to go down to the $15.50 level, and then eventually the $15 level after that. I believe that the $15 level is much more supportive psychologically and historically, so I’m looking for some type of bounce from that area to perhaps start buying. In the meantime, it looks like we are going to continue to drop from here, and therefore I think short-term sellers will continue to run the market.

FOMC Meeting Minutes

The FOMC Meeting Minutes come out and will show what the Federal Reserve is likely to do going forward. After all, the interest rate outlook for the Federal Reserve will massively influence was going to happen to precious metals overall, and of course Silver markets are very sensitive to this. After all, the Silver markets are less liquid than gold, so obviously the moves tend to be a bit more exaggerated. I am a seller of silver and the short-term, but I will be paying quite a bit of attention near the $15 level as it should be very important for the longer-term charts.

If we did bounce from here, it’s not until we clear the $16.20 level that I would be willing to buy silver as it would show a complete turnaround in momentum. Because of this, I assume that we are going to continue to see sellers jump into this market as the downtrend has been so reliable and of course nothing currently looks like it’s ready to turn it around.

SILVER Video 06.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement