Advertisement

Advertisement

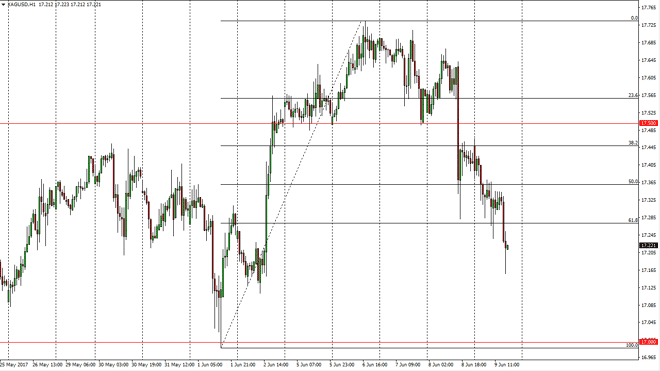

Silver Price Forecast June 12, 2017, Technical Analysis

Updated: Jun 10, 2017, 04:08 GMT+00:00

Silver markets found a lot of negative pressure during the day on Friday, as we sliced through the 50% Fibonacci retracement level, and then the 61.8%

Silver markets found a lot of negative pressure during the day on Friday, as we sliced through the 50% Fibonacci retracement level, and then the 61.8% Fibonacci retracement level. As I write this, we are currently trying to bounce a bit but I think that there is going to be a significant amount of resistance just above. Longer-term, I believe in owning precious metals but I also recognize that the volatility is going to get probably only worse, not better. Typically, Silver will be very sensitive where geopolitical concerns are brought into the equation. While gold reacts rather violently, Silver acts like gold on steroids. Because of this, being very careful in the Silver markets is one of the most important things you can do. Position sizing is the best way to combat some of the serious trouble that you can find, and that should be the first thing the pay attention to.

Resistance above

Even if we do rally from here, there are significant resistance barriers in the form of the $17.35 level, they $17.45 level, and most certainly the $17.50 level. Because of this, I believe that a short-term rally probably will find resistance and exhaustion that could turn the market back around. I believe that any of the previously mentioned resistance barriers could be opportunities to sell for the short-term, but I do believe given enough time the buyers will return for the longer-term move. Because of this, small positions are probably the best way to go. I would believe in a move above the $17.50 level for longer-term move, just as I would on a move down to the $17 level that forms a supportive daily candle. The meantime though, I expect we probably have more bearish pressure than bullish, and therefore becomes a bit of a 2-speed market.

SILVER Video 12.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement