Advertisement

Advertisement

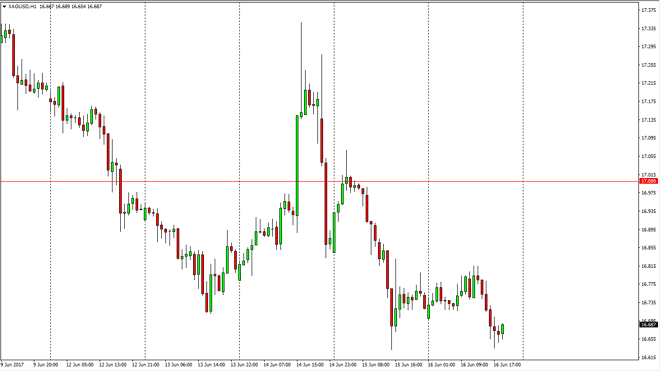

Silver Price Forecast June 19, 2017, Technical Analysis

Updated: Jun 17, 2017, 07:11 GMT+00:00

Silver markets went sideways during the day on Friday, and then dropped to the $16.50 region. I think this is an area that offers support, but the markets

Silver markets went sideways during the day on Friday, and then dropped to the $16.50 region. I think this is an area that offers support, but the markets look as if they are going to be very volatile. Silver of course is much less liquid than gold, and that will be part of what makes this market very difficult. Ultimately, I do believe that the Silver buyers come back, but in the meantime, I would be very quick to step away from this market if we show weakness. The market seems to be reacting to geopolitical concerns, which suddenly have been very quiet. However, it would only take a slight change of attitude to throw this market into a volatile fit. The market looks very likely to cause a lot of headaches for those of you that have issues dealing with volatility so therefore you may wish to step away. Because of this, the markets are probably best played either in small positions, or through options if you have that opportunity.

Longer-term trading probably better

I believe that longer-term trading is probably the best way to go, and with small positions simply because it allows you to deal with the type of noise that we will see. The geopolitical concerns around the world will continue to be a main driver of this market, so having said that it’s likely that the headlines around the world will dictate where we go next. Geopolitical concerns and of course “risk on/risk off” will continue to be a main driver of metals. Gold and silver both have been rallying due to a safety trade, so if bad news, as, Silver could rally right along with gold but gold tends to be a bit more stable overall.

SILVER Video 19.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement