Advertisement

Advertisement

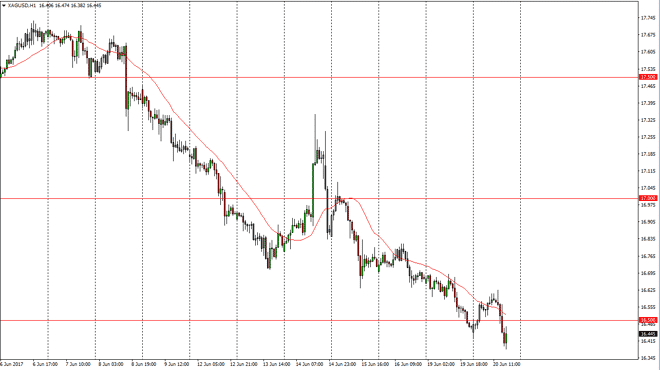

Silver Price Forecast June 21, 2017, Technical Analysis

Updated: Jun 21, 2017, 04:40 GMT+00:00

Silver markets continue to be volatile, as the Tuesday session saw the market breakdown below the $16.50 level. I believe that the fresh, new low should

Silver markets continue to be volatile, as the Tuesday session saw the market breakdown below the $16.50 level. I believe that the fresh, new low should send this market even lower, as silver markets continue to get beat up by the strengthening US dollar. With the Federal Reserve looking to raise interest rates at least a couple of times over the next year or so, it’s likely that we will continue to see people willing to step in and sell this market. However, I think that there also geopolitical concerns that could come back and play, and if that’s the case I think that silver markets will rally based upon what happens in gold. Ultimately, we also have a certain amount of industrial use for the silver markets also, so if the economic outlook continues to improve, it’s likely that the market will start buying silver as well.

Small positions

I believe this point small positions will continue to be the best way to play this market, as the volatility will make it very easy to lose money. Ultimately, the volatility will continue to be very strong, and that of course means that you will need to be very careful. However, if we were to break above the $16.65 level, that would be a “higher high”, and send this market to the upside, perhaps reaching towards the $17 level after that. We have made “lower lows” recently, so at this point it’s obviously a market that continues to have a lot of heaviness in it. The next major support level will be the $16 level, as it is a large, round, psychologically significant number and one that has been important in the past as well. One thing that you may consider is options, as it gives you a way to mitigate some of your risk.

SILVER Video 21.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement