Advertisement

Advertisement

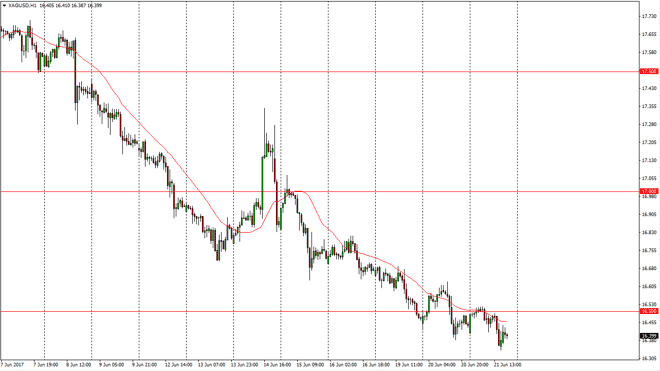

Silver Price Forecast June 22, 2017, Technical Analysis

Updated: Jun 22, 2017, 04:43 GMT+00:00

Silver markets initially tried to rally during the day on Wednesday, but found the $16.50 level to be resistive enough to send the market much lower,

Silver markets initially tried to rally during the day on Wednesday, but found the $16.50 level to be resistive enough to send the market much lower, reaching to the downside. I believe that the market continues to see downward pressure, as the 24-hour exponential moving average continues to weigh upon the white metal. I believe that given enough time, the market will try to reach towards the $16 level, a psychologically important level. I believe that near that area buyers will return, but ultimately, I think that a break above the $16.60 level in the short term would be a very bullish sign that should send this market looking towards the $17 level. As the Federal Reserve looks likely to raise interest rates relatively soon, that is weighing upon precious metals as well.

Stability needed

I believe that the market needs to be stable in order to go long, and we would need to see a daily candle that gives us an idea to go to the upside. Ultimately, the market continues to be volatile, as silver is not only a precious metal which makes it volatile, but it is less liquid than gold. Quite frankly, if gold will move 1%, silver quite often will move to. With this in mind, small positions will probably be the best way to deal with this market, as the volatility can cause losses quite rapidly. A breakdown below the $16 level would be extraordinarily bearish, and send this market looking towards the $15 level, as it is an even more psychologically important target than the $16 level. Either way, it looks as if the sellers are in control in the short-term, so I still feel that short-term selling is probably what we will continue to see.

SILVER Video 22.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement