Advertisement

Advertisement

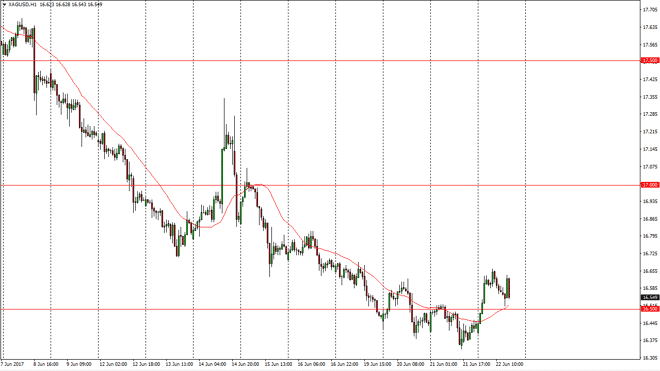

Silver Price Forecast June 23, 2017, Technical Analysis

Updated: Jun 23, 2017, 03:41 GMT+00:00

Silver markets shot higher during the day on Thursday, breaking above the $16.50 level. Ultimately, we pulled back to test that level and then bounced

Silver markets shot higher during the day on Thursday, breaking above the $16.50 level. Ultimately, we pulled back to test that level and then bounced again. However, as I record this it appears that we are going to be doing a bit of consolidating just above the $16.50 level to try to figure out where we go next. The 24-hour exponential moving average has been very reliable as of late, and it now looks as if it is trying to offer a bit of support. A break above the $16.65 level should then send this market towards the $17 level after a significant amount of time. Ultimately, the market breaking above $17 would be a very positive sign. That probably census market into a longer-term “buy-and-hold” type of scenario. In the meantime, I would expect to see quite a bit of noise and volatility in this market.

US dollar

The US dollar of course will have a significant amount of influence on where Silver goes as well. Ultimately, the market tends to move in the opposite direction of the US dollar, unless of course it is moving due to some type of geopolitical event. As the geopolitical issues around the world have calm down recently, the market looks likely to be a bit more stable than we have seen recently. Ultimately, the market offers a significant amount of opportunity for those of you who can wait through the volatility, or better yet – buy physical metal itself, as it could be a strong investment for those of you trading your retirement accounts or even just long-term investing in general. If we break down below the lows from the Wednesday session, it appears that we will then go to the $16 level after that.

SILVER Video 23.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement