Advertisement

Advertisement

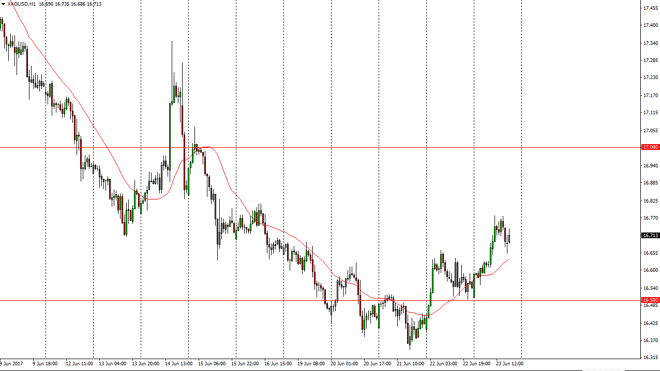

Silver Price Forecast June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:13 GMT+00:00

Silver markets bounced significantly on Friday, using the $16.50 level as support, and more importantly, a springboard. Markets look likely to continue to

Silver markets bounced significantly on Friday, using the $16.50 level as support, and more importantly, a springboard. Markets look likely to continue to find buyers though, because the $16.65 level underneath has offered support. Ultimately, I believe that we will then go looking towards the $17 level above, which is a more significant resistance barrier. I believe that the market is a “buy on the dips” situation, and ultimately, it’s likely that the market will eventually try to reach towards that area, but if we can break above the $17 level, it’s likely that we will go looking towards the $70.25 level after that.

I also recognize that the $16.50 level should be supportive, so keep that in mind as well. If we break down below that level, the market will probably go much lower. In the meantime, I think that every time it looks like the buyers are starting to come back into play, it’s time to jump in and take advantage. I also believe that if you will can trade a small enough position, you can buying dips going forward in and to a position to make large returns over the longer term.

Risk on/risk off

Silver markets continue to be volatile due to not only the US dollar, but geopolitical concerns. Keep this in mind, as fear could have money running into the precious metals markets. However, Silver tends to play second fiddle to gold, so the gold markets will probably move quicker. However, there is a bit of a “knock on effect” when it comes to this market, so with this being the case it’s likely that the markets will remain volatile but a little bit of a bit underneath them as we have seen over the last several sessions.

SILVER Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement