Advertisement

Advertisement

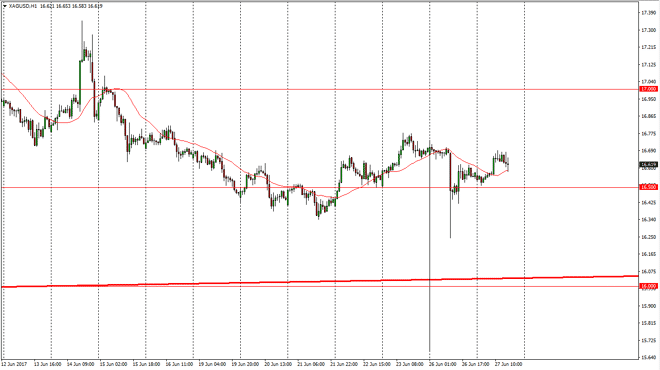

Silver Price Forecast June 28, 2017, Technical Analysis

Updated: Jun 28, 2017, 05:47 GMT+00:00

Silver markets were relatively flat during the Tuesday session as the $16.50 level continues to be supportive. I believe that the Silver markets are

Silver markets were relatively flat during the Tuesday session as the $16.50 level continues to be supportive. I believe that the Silver markets are essentially flat for a reason, as the markets are relatively quiet. In general, a lot of volatility has been sucked out of the market as we are in summer trading. Because of this, I think that the market will probably continue to follow $16.50 as a supportive area, but quite frankly I don’t see any trigger for a larger move yet. I think that the market is essentially going to flatline, and therefore it becomes a market that is very difficult to trade. However, I do believe that longer-term we may have the ability to pick up Silver markets on the cheap, perhaps even adding physical silver in this general vicinity. I believe that the $16 level below is a massive support level, and if we can stay above there the only thing you can do is buy.

Geopolitical risks?

I believe that the geopolitical risk out there of course favors the upside for precious metals, but we certainly haven’t had anything as of late. Nonetheless, I think it’s likely that we will have something happen eventually that send this market higher. If we can break above the $17 level, then I think we can start reaching towards the $20 level. I like bowling pullbacks in this market, once we get some type of volatility. For the longer-term, I am buying physical silver rounds to take advantage of the longer-term appreciation of silver. If you don’t have that ability, perhaps buying longer dated options could be a good way to come into the futures market and take advantage of what should end up being a positive move given enough time.

SILVER Video 28.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement