Advertisement

Advertisement

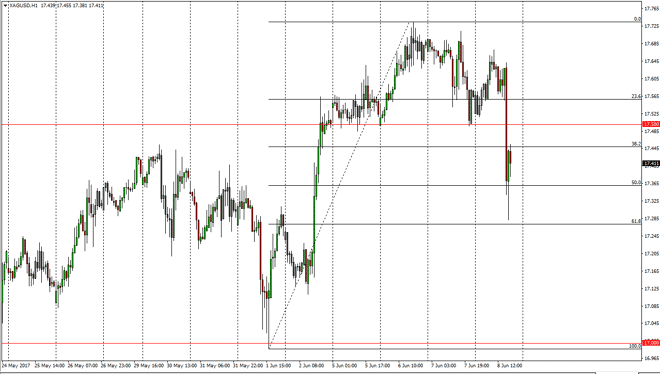

Silver Price Forecast June 9, 2017, Technical Analysis

Updated: Jun 9, 2017, 04:22 GMT+00:00

Silver markets had a very volatile session on Thursday, initially rallying, but then falling apart. We not only broke down a bit, we sliced through the

Silver markets had a very volatile session on Thursday, initially rallying, but then falling apart. We not only broke down a bit, we sliced through the $17.50 level almost instantly. After that, we dropped down towards the $17.28 level, but found enough support to bounce significantly and form a huge hourly hammer. That hammer lines up nicely with the 61.8% Fibonacci retracement level from the move higher over the last couple of weeks, and therefore looks as if the buyers are coming back in the pickup Silver “on the cheap.”

Buying dips? Here’s your chance.

What I find interesting is that we found the perfect Golden ratio, and of course forming a huge hammer. Not only that, but the following candle looks to be forming a hammer as well, so I think we will find buyers in this general vicinity. I recognize that the $17.50 level above will probably be resistive, as it was supportive in the past. Nonetheless, I still believe that the longer-term target of $18 is far too interesting and juicy for traders to ignore, and that’s exactly what I expect to see. I believe that if we can break above the $18 level, then we can go to the $20 level above there which is my longer-term target. Ultimately, I have no interest in shorting this market and I believe it’s only a matter of time before the buyers return every time we dip. The gold markets look very well supported underneath as well, and the 2 markets tend to move in the same directions. Because of this, I believe that Silver will have a bit of a bid and it going forward, and should continue to find buyers every time we dip as there is so much interest.

SILVER Video 09.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement