Advertisement

Advertisement

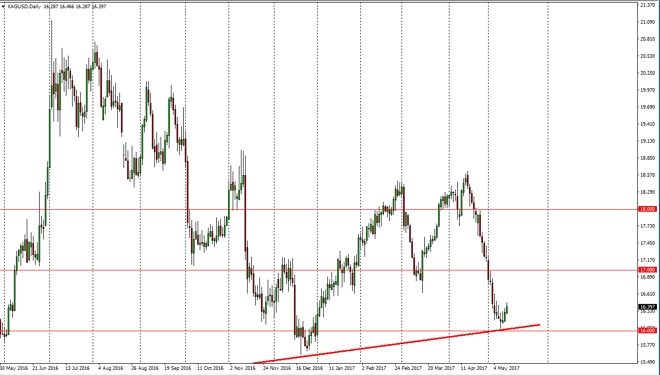

Silver Price Forecast May 15, 2017, Technical Analysis

Updated: May 13, 2017, 05:28 GMT+00:00

Silver markets rallied during the Friday session, after bouncing off of the $16 level on Wednesday. This is a market that is testing a major uptrend, and

Silver markets rallied during the Friday session, after bouncing off of the $16 level on Wednesday. This is a market that is testing a major uptrend, and that being the case the market looks likely to try to rally from here. I do recognize that there is a lot of exhaustion just above, but quite frankly the real fight is below at the $16 level. As long as we can stay above there, it’s likely that the buyers will remain, but if we were to break down below the $16 level, the market could fall rather precipitously. I believe that the next couple of sessions will continue to be very important, and look at a move above the $16.60 level as a buying opportunity, reaching towards the $17 level above. The market has been very negative as of late, so it would not surprise me at all to see a bit of a bounce from here. I believe that the $17 level above should be massively resistive, and it looks likely that it will have an effect on the market on the bounce. I believe as long as we can stay below the $17 level, it’s likely that the market will fall.

Volatility

I believe that the market is going to continue to be volatile, and the $17 level above is where I believe the longer-term decision will be made if we can go to the upside. We could get a bit of a bounce in the short-term, but that’s likely to be choppy and dangerous. I believe that a breakdown below the $16 level is actually the easier to trade today, as it would be so obvious. However, we have to work with what the market gives us, and react appropriately.

SILVER Video 15.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement