Advertisement

Advertisement

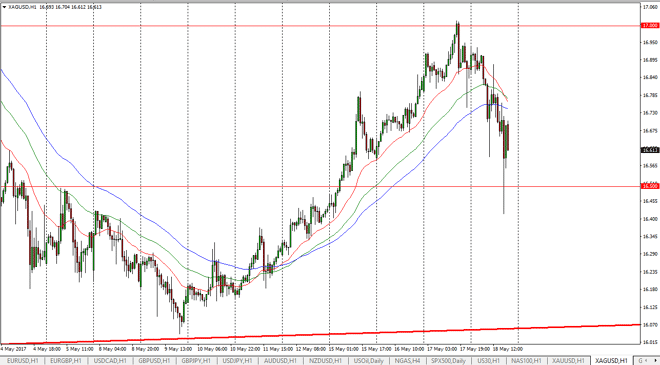

Silver Price Forecast May 19, 2017, Technical Analysis

Updated: May 19, 2017, 03:47 GMT+00:00

Silver markets fell during the session on Thursday, as the $17 level seems to be a bit too resistive for the market to break above. Because of this, the

Silver markets fell during the session on Thursday, as the $17 level seems to be a bit too resistive for the market to break above. Because of this, the market then reached towards the major support level at the $16.50 level and then bounced. I think if we can break below there, the market will then go looking for the uptrend line on the daily chart, which is somewhere near the $16.10 level. Alternately, if we can bounce from that area I think we will then make another attempt on the $17 level above. This is a significant breakdown though on the hourly chart, so would not surprise me at all to see a little bit of follow-through to the downside. Either way, the market to get to be very choppy and I think that the market will continue to be highly leveraged to some type of risk appetite situation.

Headlines continue to create noise

Headlines coming out of Washington DC will continue to create noise, because quite frankly there is a lot of uncertainty when it comes to the political situation in the Washington DC arena. The market will more than likely stay within this range between the $16.50 level on the bottom and the $17 level on the top. Ultimately, this is a market that can move rather rapidly, as it is less liquid than gold for example. Because of this, ultimately, it’s going to be a very noisy market that’s going to take a significant amount of wherewithal to deal with. The market continues to be a place where people may run for safety, so negative headlines are essentially which are going to need to see Silver skyrocket. Pay attention to gold, it quite often will list this market in sympathy as well.

SILVER Video 19.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement