Advertisement

Advertisement

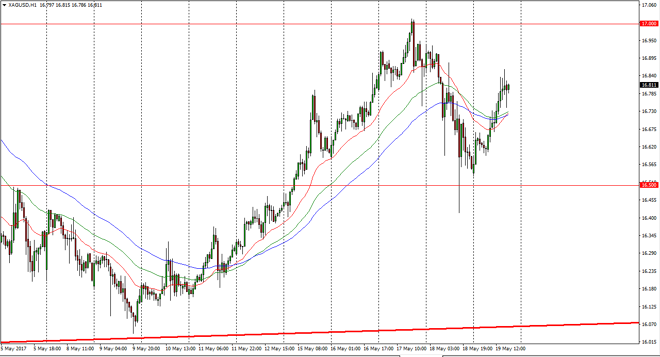

Silver Price Forecast May 22, 2017, Technical Analysis

Updated: May 20, 2017, 04:21 GMT+00:00

Silver markets had a bullish session on Friday, breaking to the upside from the Thursday range. If we can continue the bullish pressure, I feel that the

Silver markets had a bullish session on Friday, breaking to the upside from the Thursday range. If we can continue the bullish pressure, I feel that the market then goes to the $17 handle, and possibly beyond. When I look at the longer-term charts, there does seem to be a significant amount of support for Silver, and the moving averages that I follow are starting to cross on the hourly chart. Because of this, I think that dips will continue to be buying opportunities for traders that are patient enough to wait for them. As we close out the week, there seems to be plenty of political turmoil out there to move people into the precious metals sector, so pay attention the gold, as it will often lead where Silver goes next.

A break above $17

A break above the $17 level is extraordinarily bullish, and that would not only have me long of this market, but have me adding to a position. Silver then will go hunting for the $17.50 level next, and the $18 level after that. Silver markets tend to be very attracted to the $.50 levels, so keep that in mind as you move your stops back and forth. Silver also tends to be a lot less liquid than other contracts, so the move is can be very sudden and violent. As you know, that can work both ways but it seems as if the buying pressure is starting to pick up, and that could lead to decent profits for those willing to take the long side of the bet. I have no interest in shorting anytime soon, as this market shows support on longer-term charts as well, which of course drives the overall attitude longer-term and therefore not worth fighting.

SILVER Video 22.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement