Advertisement

Advertisement

Silver Price Forecast May 23, 2017, Technical Analysis

Updated: May 23, 2017, 06:06 GMT+00:00

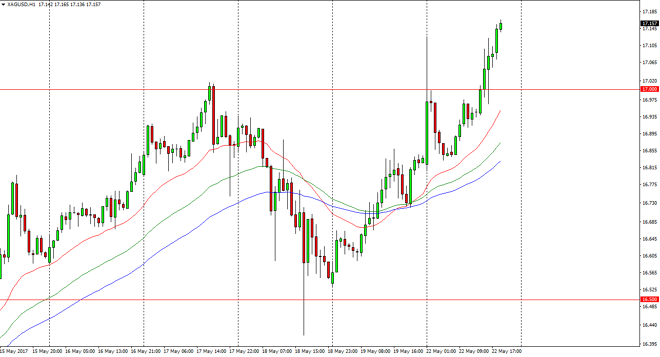

Silver markets had a very explosive session on Monday, reaching the $17 level almost immediately, before pulling back and reloading the bullish pressure.

Silver markets had a very explosive session on Monday, reaching the $17 level almost immediately, before pulling back and reloading the bullish pressure. We eventually broke above the $17 level which of course is very bullish as it is a large, round, psychologically significant number, and it now looks as if we are ready to continue going higher. Pullbacks of this point should be value, as it appears that the precious metals market is starting to heat up again. It’s not just silver, gold rallied as well, and typically one both of them start moving in the same direction, we have a nice trade setting up. I believe that the $17.50 level will be somewhat resistive, but ultimately the real resistance is probably closer to the $18 handle.

Buying dips

I continue to buy dips in this market, and I believe that the $17 level will now act as significant support. Even if we break down below there, as long as we can stay above the $16.81 level, I feel that the market will continue to go higher. The moving averages that I follow are all starting to turn to the upside, and they all are spread out quite nicely. It typically means that the momentum has picked up again, and that it’s time to continue going in that particular direction. Silver markets do tend to be volatile, but ultimately I think the buyers are very much in control, and certainly would not be interested in finding this move. The markets will obviously see a certain amount of resistance occasionally, but these pullbacks will end up being value in a market that continues to show extreme amounts of choppiness. Keep in mind the geopolitical concerns and headlines of course can have an effect on the precious metal sector, so that will probably be the biggest headache to deal with.

SILVER Video 23.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement