Advertisement

Advertisement

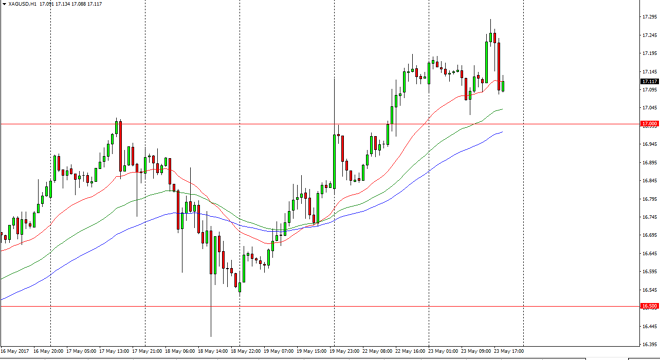

Silver Price Forecast May 24, 2017, Technical Analysis

Updated: May 24, 2017, 03:44 GMT+00:00

Silver markets initially fell during the session on Tuesday, but found enough support at the 24-hour exponential moving average to turn around and bounce,

Silver markets initially fell during the session on Tuesday, but found enough support at the 24-hour exponential moving average to turn around and bounce, reaching towards the $17.30 level. That’s an area that caused enough resistance to turn the market back around, and now late in the US session we are starting to see Silver test the lows again. The $17 level below should be supportive, so I suspect that the buyers are waiting to pick up silver in this general vicinity. If we broke down below the $17 level, the market could go looking for the $16.75 level, which is a psychologically important level. The market looks very likely to continue to go to the upside over the longer term, especially if there is more of the “safety trade” that we had seen in the gold market.

The US dollar

Pay attention to the US dollar, as it is a massive influence in the silver market as well as the risk appetite. The US dollar strengthening is negative for silver in general, unless of course are some type of general panic. I don’t think we’re going to see that, but it does look as if silver is still very much in an uptrend so I don’t have any interest in shorting, least not until we break down below the $16.75 handle, which I think being broken to the downside should send this market looking towards the $16.50 level below which is significant. Ultimately, the market continues to look towards the $18 level longer term, at least as far as I can see and that’s my longer-term target right now. Silver is always volatile, so these pullbacks shouldn’t be much of a surprise as it is not as stable as the gold markets tend to be longer term.

SILVER Video 24.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement