Advertisement

Advertisement

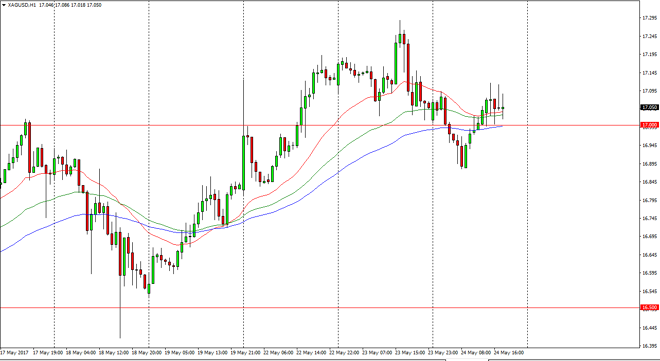

Silver Price Forecast May 25, 2017, Technical Analysis

Updated: May 25, 2017, 03:49 GMT+00:00

Silver markets have been choppy during the Wednesday session, initially dropping well below the $17 level but found enough support near the $16.85 level

Silver markets have been choppy during the Wednesday session, initially dropping well below the $17 level but found enough support near the $16.85 level to bounce back above the $17 level as the Americans took over. The market now looks as if it is trying to figure out where to go next, and the area below the $17 level looks to be rather supportive. Because of this, I do favor buying, but we would have to break above the highs of the session on Wednesday to have me thinking about that, and I also recognize that a certain amount of volatility and choppiness would be expected. Silver markets are typically choppy so if you spend any time trading this contract, none of that should be a surprise. However, if you don’t then Silver may be a very difficult market to deal with as it acts very erratic.

Patience

You’re going to have to exercise a certain amount of patience if you’re going to be involved in this market. Although it does not sound like much, they moved to the $17.50 level seems to be in the cards, and that could be a nice trade. However, you’re going to see quite a bit of noise between here and there so keep that in mind. As far as selling is concerned, a breakdown below the $16.75 level could send this market down to the $16.50 level but in general I have a longer-term bias to the upside. Silver tends to be very volatile, so keep your position size small is probably the best advice I ever got trading the futures market. If we can break above the $17.50 level, then we could go looking for the $18 level which is my longer-term target in the market.

SILVER Video 25.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement