Advertisement

Advertisement

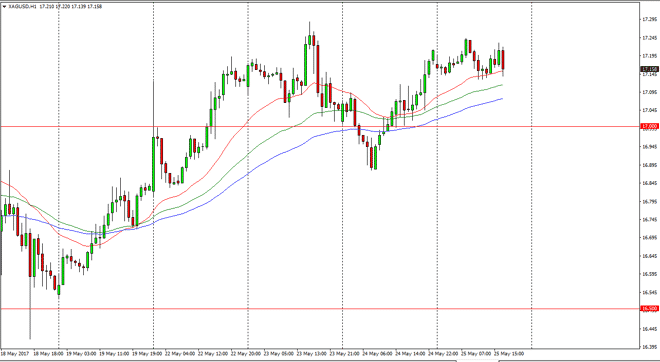

Silver Price Forecast May 26, 2017, Technical Analysis

Updated: May 26, 2017, 04:06 GMT+00:00

Silver markets did very little during the day on Thursday, as we continue to hang just above the $17.10 level. I expect to see a significant amount of

Silver markets did very little during the day on Thursday, as we continue to hang just above the $17.10 level. I expect to see a significant amount of support near the $17 level as well, and as a result of this I believe that pullbacks offer value in a market that has been reasonably strong as of late. Silver is a little bit different of an animal than gold, as not only is it a safety play at times, the Silver markets are also highly influenced by the industry as Silver is also an industrial metal. With this being the case, pay attention to the other industrial metals markets, such as copper. If they continue to rise, then Silver should see a little bit of a “knock on effect.” Recently, the US dollar has been a little bit softer, and that of course helps over as well as it sometimes is thought of more as a precious metal.

Buying dips

I believe that buying dips will be the way to go in this market going forward. Just as I said in gold, you may be better served placing smaller trades initially, as the markets will continue to be volatile regardless what happens next, so therefore mitigating risk it should be the first thing you think of when your trading this market. If you are buying physical silver, that’s a completely different story as the leverage doesn’t exist, so therefore it’s not to be worried about. I think that this market is going to head towards the $18 level, but it may take a bit of time to get there and with that being the case a little bit of wherewithal will be necessary trading this market. If we break down below the $16.75 level, then the market may roll over to the $16.50 level.

SILVER Video 26.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement