Advertisement

Advertisement

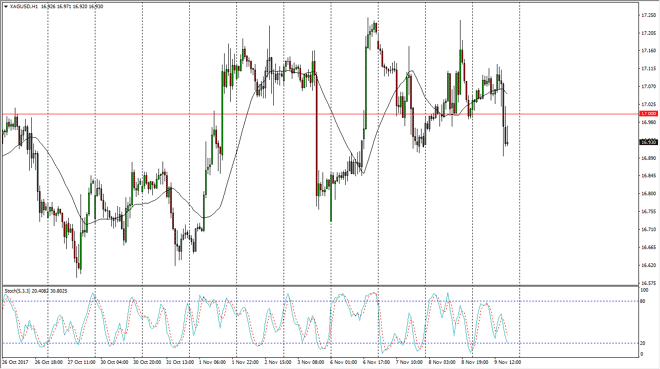

Silver Price Forecast November 10, 2017, Technical Analysis

Updated: Nov 10, 2017, 04:35 GMT+00:00

Silver markets initially tried to rally on Thursday but broke down below the $17 level again, and looks set to drift even lower. The stochastic oscillator

Silver markets initially tried to rally on Thursday but broke down below the $17 level again, and looks set to drift even lower. The stochastic oscillator is starting to roll over into a somewhat negative form, and I think that we are going to go looking towards the $16.75 level again, before the buyers may return. Overall, I think that the markets are attracted to the $17 level in general and it is essentially “fair value.” Because of this, short-term back and forth trading is probably the best thing you can hope for in the silver market, unless of course you are a longer-term trader looking to buy and hold. I think that the $16.50 level underneath is massive support, but I can also suggest that $17.50 above is just as massive resistance. Silver can continue to be very choppy for a very long time, especially considering there are so many different elements pulling and pushing at the same time.

Keep in mind that any type of geopolitical shock around the world could send silver higher, but quite frankly you need to take profits rather quickly as those rallies tend to be short-lived. If the US dollar strengthens, and I think it will eventually, this silver market will probably drop down towards the $16 level. However, the volatility in the short term makes this a market that’s probably better to play in the options market, with maybe a bit of a “reversion to the mean” type of thought process, using the $17 level as the mean. I think that it’s going to be very difficult to get a longer-term move, and is going to take some type of major external influence. Right now, I just don’t see where it’s coming from as precious metals continue to chop around.

SILVER Video 10.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement