Advertisement

Advertisement

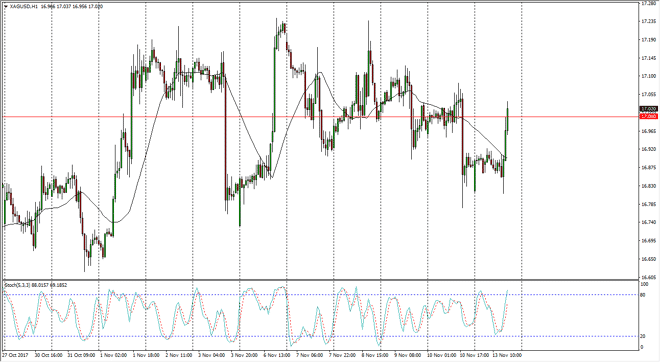

Silver Price Forecast November 14, 2017, Technical Analysis

Updated: Jan 23, 2018, 08:55 GMT+00:00

Silver markets were rather quiet initially during the trading session on Monday but then shot much higher as the Americans took over. Breaking above the

Silver markets were rather quiet initially during the trading session on Monday but then shot much higher as the Americans took over. Breaking above the $17 level was somewhat significant, but let us not forget that there is a lot of noise just above. I don’t see anything on this chart that tells me we are about to change the overall attitude of the market, so I anticipate that we are going to see sellers come back into the market, closer to the $17.20 region. Because of this, and the strong consolidation that we have seen for some time, I’m using the stochastic oscillator to look for an overbought condition that I can take advantage of and start selling. Remember, the value of the US dollar is highly influential when it comes to the precious metals market, and silver is especially sensitive.

I also believe that there is significant support down at the $16.75 handle, so I’d be a buyer on oversold conditions in that area. Until we get some type of directionality in the precious metals markets overall, I think that the Silver markets are to be played back and forth on short-term charts. If you are a longer-term trader, in general, you could be a physical holder of silver, which is never truly a bad thing, on a long enough timeline. In general, I think that the only people that should be trading Silver now are the well-capitalized and nimble. If you are neither of those, you have no business in this market. Otherwise, day traders and the like will continue to do quite well in the summer markets as we have such a well-defined area to trade within. Smaller trading positions are probably necessary.

SILVER Video 14.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement