Advertisement

Advertisement

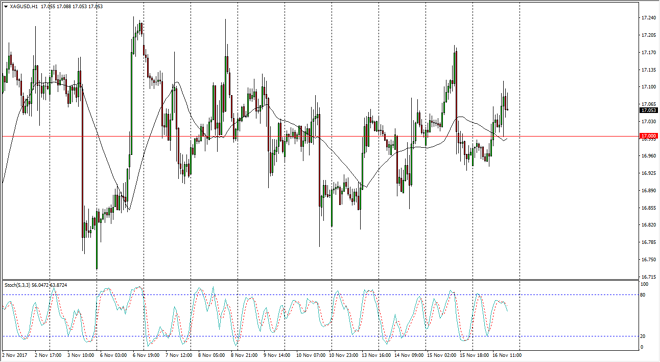

Silver Price Forecast November 17, 2017, Technical Analysis

Updated: Nov 17, 2017, 05:00 GMT+00:00

Silver markets have gone sideways initially during the trading session on Thursday, but then broke above the $17 level. By doing so, it looks as if the

Silver markets have gone sideways initially during the trading session on Thursday, but then broke above the $17 level. By doing so, it looks as if the market is trying to reach towards the $17.20 level again, but that is an area that should continue to be resistive. I think that the market continues to be very choppy, and sober typically is, so that’s not a surprise. However, we roll over from here I think we are simply going to run out of volatility, and hang about the $17 level for the time being. I have been trading this market in a “reversion to the mean” attitude, meaning that every time we get a little bit too far away from $17, I start aiming for it again. I believe that the $17.20 level above is resistance, and the $16.80 level underneath should continue to be support. In general, I believe that the market remains a short-term trading opportunity at best, and longer-term traders will be best served holding onto physical silver more than anything else.

However, if we are to break out of this range, the next trade is simple: you follow whichever direction we break out of and aim for another $.30 from there. In other words, a breakout to the upside has this market looking for the $17.50 level, while a breakdown has this market looking for the $16.50 level. In general, this market has been extraordinarily noisy for several different reasons, not the least of which is going to be that the financial markets seem a bit exhausted as we have had such a bullish run to the upside in the stock markets, and now are sitting sideways there as well. I think there are a lot of questions out there, and that continues to make silver difficult.

SILVER Video 17.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement