Advertisement

Advertisement

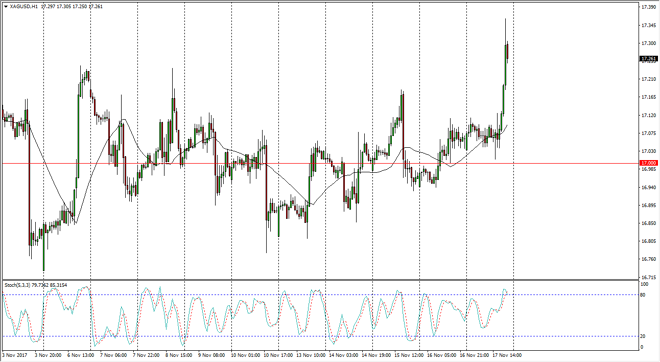

Silver Price Forecast November 20, 2017, Technical Analysis

Updated: Nov 18, 2017, 12:30 GMT+00:00

Silver markets went sideways initially on Friday, bouncing above the $17 level. We rallied significantly later in the day, as the US dollar falls. We

Silver markets went sideways initially on Friday, bouncing above the $17 level. We rallied significantly later in the day, as the US dollar falls. We tested the $17.35 level, insert a pull back slightly towards the end of the day. It’s likely that we will find buyers on a pullback now, perhaps sending this market to the $17.50 level after that. That’s an area that will be resistive, and I suspect that we will get a pullback from there as well. I anticipate that Silver will continue to be choppy, that’s normally the case anyway, but with the lack of the tax bill coming out of Congress, that’s going to continue to put upward pressure on precious metals in general. As soon as they change things though, we will more than likely have the US dollar rallied and enough to cause precious metals to fall drastically. If that happens, expect support at the $17 level again.

Personally, I prefer to buy silver in physical form, as it is much safer than levering up a massive position. Using CFD markets also serves the same purpose as and that, as you can keep a small position going forward, keeping the danger to your account to a minimum. If we were to break down below the $17 level, the market will more than likely go looking towards the $16.85 level again. Right now though, it looks as if the buyers have made a bit of headway, as we have made a fresh, new high on the hourly chart, at least as far as the last couple of weeks is concerned. Longer-term, the $18 level is the top of major consolidation, so that would be a massive target, and then perhaps resistance and a possible pushback.

SILVER Video 20.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement