Advertisement

Advertisement

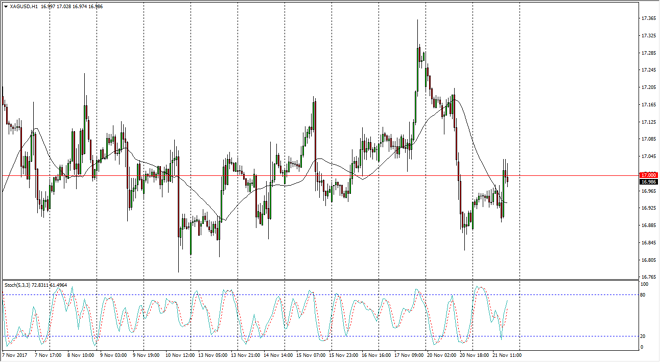

Silver Price Forecast November 22, 2017, Technical Analysis

Updated: Nov 22, 2017, 05:19 GMT+00:00

The Silver markets were very volatile on Tuesday, reaching towards the $17 level above, which for my money has essentially been “fair value.” I believe

The Silver markets were very volatile on Tuesday, reaching towards the $17 level above, which for my money has essentially been “fair value.” I believe that we are essentially consolidating between $17.20 on the top, and the $16.80 level on the bottom. Because of this, $17 seems to be where the market wants to end up, and therefore I am simply going back and forth in this market when we get a little bit too far away from that level. I don’t see the reason for Silver to break out or breakdown, and have been using the stochastic oscillator to form trading signals. However, that’s not always the most reliable indicator, so it is secondary at best in my trading.

Overall, I think that the market will continue to tread water between now and the end of the year, unless there is some type of external influence, perhaps a geopolitical issue, or maybe the Federal Reserve being a bit more hawkish than initially anticipated. I think that Silver is probably very choppy and difficult to deal with, but if you have the ability to trade short-term charts, this might be a nice way to put money to work over the next several weeks. After New Year’s Day, we may see more volatility under the market, but I think right now it’s likely that Silver continues to be somewhat difficult to get a handle on for a longer-term move. Having said that, the Americans have just labeled North Korea as a terror supporting nation, so it’s possible there may be something coming out of that part of the world that gets people scared and running for precious metals. However, we have seen in the past that any search higher tends to be short-lived.

SILVER Video 22.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement