Advertisement

Advertisement

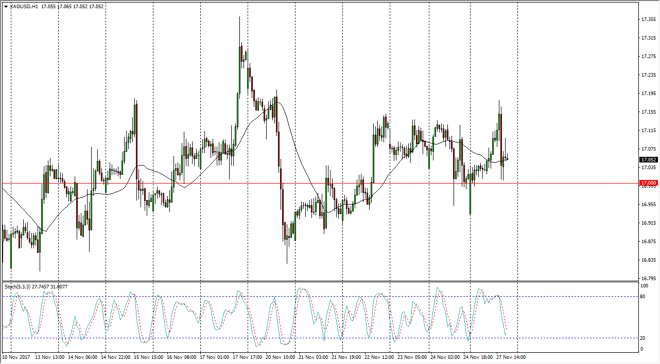

Silver Price Forecast November 28, 2017, Technical Analysis

Updated: Nov 28, 2017, 05:27 GMT+00:00

Silver markets initially gapped lower at the open on Monday, but then shot straight through the $17 level yet again, reaching towards the $17.17 handle.

Silver markets initially gapped lower at the open on Monday, but then shot straight through the $17 level yet again, reaching towards the $17.17 handle. We then pulled back significantly to test the $17 level where we found support again. The market continues to be very choppy, and I believe that the volatility in Silver will continue to be very difficult to deal with, as the US Congress continues to cause a lot of volatility due to a lack of tax reform. The $17 level is essentially “fair value”, and I think that the market will continue to be attracted to that level until we get some type of clarity as far as future direction is concerned. I don’t like trading silver for anything less than a short-term scalp currently, and I believe that will probably continue to be the case. If we break down below the $16.80 level, then support has given way and we could go lower, perhaps down to the $16.50 level. A break above the $17.25 level sends this market much higher, perhaps reaching towards the $18 level after that.

The gist of the story is that Silver is almost impossible to trade for any length of time currently, and I believe that the best way to look at this market is one that is offering range bound and short-term trading, perhaps using the stochastic oscillator as a guidepost is the way to go. I think it’s a market that is best approached as one that will eventually go back to $17, so if we get too far from that level, you just chase the market back to that level. I would use small positions though, because quite frankly the volatility normally means that eventually we will make a significant move, and Murphy’s Law dictates that you will be on the wrong side of it.

SILVER Video 28.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement