Advertisement

Advertisement

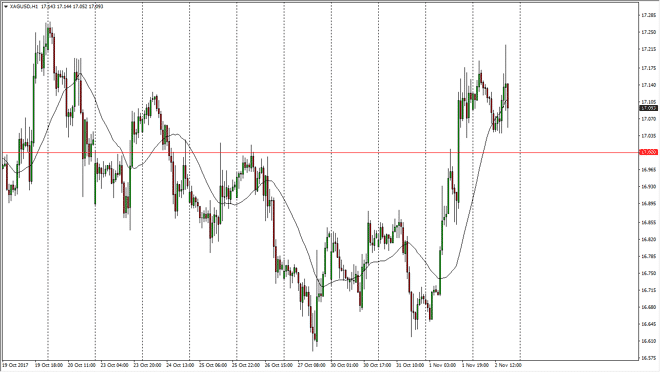

Silver Price Forecast November 3, 2017, Technical Analysis

Updated: Nov 3, 2017, 05:19 GMT+00:00

Silver markets went back and forth during the course of the session on Thursday, as we continue to hover above the $17 handle. This area has been fair

Silver markets went back and forth during the course of the session on Thursday, as we continue to hover above the $17 handle. This area has been fair value recently, and the $17.50 level above being resistance. Alternately, the $16.50 level underneath is supportive, and I think that the market continues to be one that will be very choppy, and the US dollar course will have a significant influence on the precious metals markets overall, as if it rallies, that often works against the value of silver and gold both. I believe that the jobs number coming out today of course will have a lot to do with what happens with the precious metals market, as the US dollar will react drastically. The expected number is 310,000 for the month of October, and the market could react accordingly.

I believe that the US dollar should continue to strengthen, so given enough time, I anticipate that the silver market will roll over. The $17.50 level above should be an area where we are going to find selling, so if we do rally to that area, I suspect that we could get an opportunity to go short again. Alternately, if we break down below the $17 level, the market should then go to the $16.50 level after that. Overall, this continues to be a very noisy, and that of course should send this market back and forth for short-term trading at best. Silver remains very slippery, and quite frankly if I am going to be bothered trading it, I should be more inclined to trade physical silver or at least CFD markets, as there is more likelihood of withstanding the type of volatility that is quite often seen in the futures market, and therefore silver itself.

SILVER Video 03.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement