Advertisement

Advertisement

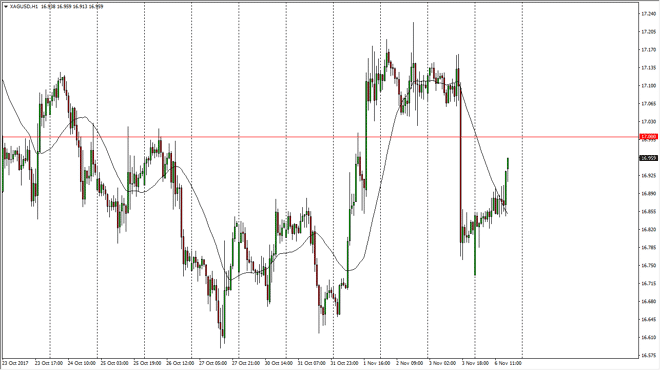

Silver Price Forecast November 7, 2017, Technical Analysis

Updated: Nov 7, 2017, 07:02 GMT+00:00

Silver markets rallied significantly during the day on Monday, crashing into the $17 level. This is an area that has essentially been “fair value”, and it

Silver markets rallied significantly during the day on Monday, crashing into the $17 level. This is an area that has essentially been “fair value”, and it looks likely that the market will continue to try to find that level every time we get a bit too far from it. The $17.20 level above offers a significant amount of resistance, and therefore at the first signs of selling pressure in that general vicinity, I’m willing to start shorting silver. Although we could go higher from here, Silver has to fight through a lot of noise, so I don’t have any interest in being part of that trade. Ultimately, this is a market that is very thin at times, and that is going to cause issues. As I record this, it looks likely that the $17 level will continue to cause a lot of volatility, and with that in mind I am very hesitant to be involved in the Silver markets, least not using a lot of leverage.

From a longer-term perspective, I own quite a bit of physical silver. I like silver, but I also recognize that the leverage is one of the major problems that traders face. CFD markets are excellent for silver, because it gives you the ability to trade less than an entire futures contract, which can be very difficult. If we were to break above the $17.25 level, then I think you can jump into the futures market and try to lever up, making quite a bit of profit along the way. In the meantime, I like the idea of rolling over, and shorting this market back towards the $16.80 level. The one thing you can count on in silver, is going to be continued volatility as per usual.

SILVER Video 07.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement