Advertisement

Advertisement

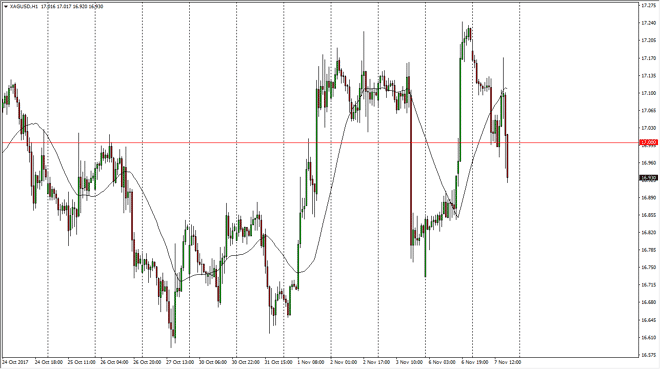

Silver Price Forecast November 8, 2017, Technical Analysis

Updated: Nov 8, 2017, 05:27 GMT+00:00

Silver markets gapped lower at the open on Tuesday, breaking down below the $17 level after initially trying to bounce. Silver markets of course remain

Silver markets gapped lower at the open on Tuesday, breaking down below the $17 level after initially trying to bounce. Silver markets of course remain volatile, they always are, so therefore I do not like trading the futures market when it comes to silver, because it can be so damaging to your bottom line. However, the market looks likely to reach towards the $16.75 level again, and I believe that the $17 level continues to be an area that traders bounce around back and forth. I believe that the market continues to be very noisy, but that’s typical a silver as it is essentially gold on steroids. The US dollar has its influence on the market, as when it strengthens it tends to punish the precious metals overall, and silver being less liquid than the gold markets tends to move quite rapidly. However, overall, I think that if you are a range bound trader, silver is offering a nice opportunity as it looks like the $16.50 level on the bottom and the $17.50 level on the top continue to be areas of concern.

I don’t see and into the back and forth type of action that we have seen recently, so I continue to look at this market from a range bound aspect. I believe that the market would more than likely continue to follow the stochastic oscillator in general, although price action is much more important. Look at the stochastic as a potential secondary indicator, nothing more than that. Pay attention to the US dollar, and more importantly the US Dollar Index, which of course gives us an idea of how the greenback will influence this market. As the US Dollar Index rises, I would be short of silver and of course vice versa.

SILVER Video 08.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement