Advertisement

Advertisement

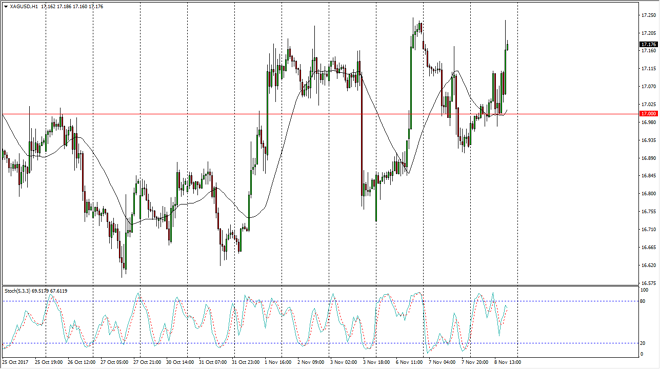

Silver Price Forecast November 9, 2017, Technical Analysis

Updated: Nov 9, 2017, 05:22 GMT+00:00

Silver markets have enjoyed a strong session on Wednesday, reaching towards the $17.25 level. This is an area that continues to offer resistance though,

Silver markets have enjoyed a strong session on Wednesday, reaching towards the $17.25 level. This is an area that continues to offer resistance though, and I think that the $17.50 level above continues to be the top of the overall consolidation. I think that the $17.50 level is massive resistance, so I do not have any interest in buying silver at this point. Quite frankly, I think that the market is probably getting ready to roll over a bit, as the market seems much more comfortable with the $17 level. The stochastic oscillator does look as if it is trying to roll over, and we have seen a bit of divergence as of late. I also recognize that the US dollar has been strengthening for some time, and I think that the markets continue to favor the greenback in general, as the Federal Reserve is one of the few central banks that are looking to raise interest rates. After all, the ECB has recently stated that they were going to extend quantitative easing, in time, not size. In other words, it’s likely that we will see quantitative easing for much longer than originally thought. The Bank of England also is a bit softer than people thought they would be, as although they raised interest rates recently, they suggested that it was going to be a while before we saw another one. On the other hand, the Federal Reserve looks likely to raise interest rates several times over the next 6 months. That of course is good for the US dollar longer-term, and by extension works against the value of precious metals. This I believe continues to put a ceiling in this market, and as we struggled at the $17.25 level, and therefore just don’t have the impulsivity to break out.

SILVER Video 09.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement