Advertisement

Advertisement

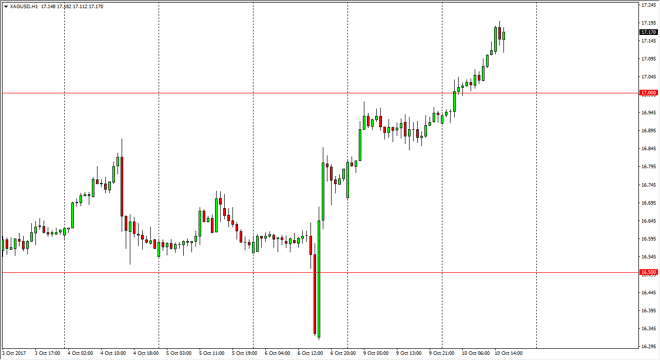

Silver Price Forecast October 11, 2017, Technical Analysis

Updated: Oct 11, 2017, 05:27 GMT+00:00

Silver markets broke out during the day on Tuesday, clearing the $17 level. This of course is a certain amount of resistance that has been overcome, and

Silver markets broke out during the day on Tuesday, clearing the $17 level. This of course is a certain amount of resistance that has been overcome, and it should now offer plenty of support. Short-term traders will of course be attracted to this market, as the next obvious target will be the $17.50 level above. Keep in mind that today features the FOMC Meeting Minutes, and that of course can have a certain effect on the US dollar, which this market will move inversely from. If the FOMC seems to be more hawkish than originally thought, that could dry the value the dollar higher, thereby driving the value of silver lower. However, I think there are more things to pay attention to when it comes to precious metals.

Geopolitical concerns

I continue to think that the path of least resistance is probably higher for precious metals overall, as they had recently pulled back significantly, as risk appetite started to pick up. However, there are plenty of geopolitical issues out there that could cause a bit of trouble right now including North Korea, Turkey, Syria, and of course the independence movement going on in Spain. With this in mind, keep an eye on precious metals overall, as I think that the markets are ready to go higher. I believe that the $17 level will offer support, but if we were to break down below $16.85, we could drop to $16.50. Overall, I believe the precious metals are going to grind their way higher, but I’m not looking for any type of explosive move, just a general return to precious metals as we had recently had a significant pullback in both gold and silver, offering value for those who are looking for longer-term trades.

SILVER Video 11.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement