Advertisement

Advertisement

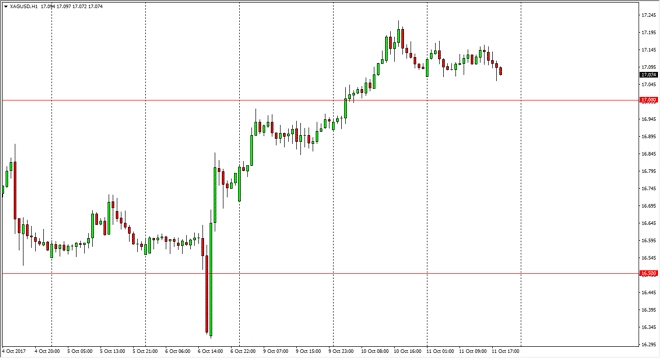

Silver Price Forecast October 12, 2017, Technical Analysis

Updated: Oct 12, 2017, 04:55 GMT+00:00

Silver markets went back and forth during the day on Wednesday, as we continue to see support at the $17 level which of course is a large, round,

Silver markets went back and forth during the day on Wednesday, as we continue to see support at the $17 level which of course is a large, round, psychologically significant number. That area should continue to offer support as it was resistance, but I think that any type of bounce from here probably have this market looking for the $17.25 level again, and then the $17.50 level. On the other hand, if we break down below the $17 level, and more importantly the $16.80 level, the market could break down significantly and reach towards the $16.50 level. Ultimately, this is a market that should continue to be choppy going forward. Remember, Silver is much more volatile than gold, but it does tend to move right along with it. That being said, pay attention to gold, and my give you a “heads up” as to where Silver goes next.

The FOMC Meeting Minutes being released during the Wednesday session should continue to drive this market overall. Ultimately, the market should continue to see a lot of influence coming from the US dollar, and that being said, the market will react to what the Federal Reserve is going to do. If they become more hawkish, then that will work against precious metals overall. On the other hand, if the Federal Reserve looks dovish, and catches the market somewhat off guard, the market should continue to go to the upside, and having said that I think that Silver will be a gauge as to what the risk appetite and overall attitude of the market is going to be. Silver markets are very thin, but do offer the ability to trade from longer-term standpoints if we can keep our position small. Ultimately, this is a market that continues to be dangerous for those who are overleveraged.

SILVER Video 12.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement