Advertisement

Advertisement

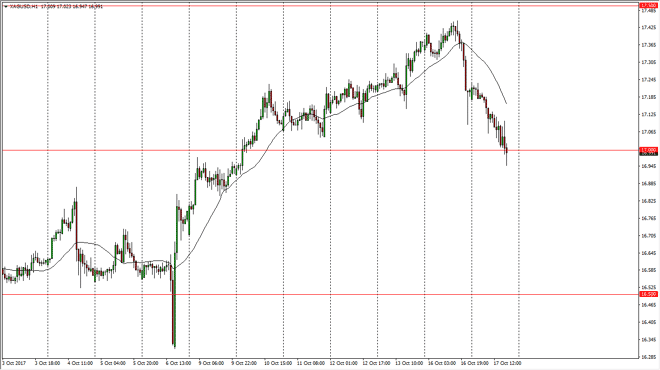

Silver Price Forecast October 18, 2017, Technical Analysis

Updated: Oct 18, 2017, 04:57 GMT+00:00

Silver markets fell during the bulk of the session on Tuesday, reaching towards the $17 level. This is an area that is obviously psychologically

Silver markets fell during the bulk of the session on Tuesday, reaching towards the $17 level. This is an area that is obviously psychologically important, and therefore I think it will be interesting to see what happens next. However, you can see that the 24-hour exponential moving average on the hourly chart has turned decidedly negative, so we could get a bit of follow-through. If that’s the case, and we break down below the $16.80 level, I think that the market reaches towards the $16.50 level rather quickly. A lot of this is going to come down to the US dollar, and what it does in general.

Remember, the precious metals markets are highly influenced by the US dollar and what it’s doing, so if we start to see US dollar strength around the Forex world, that will weigh upon Silver. However, you should also keep in mind that there is a bit of a safety bid when it comes to precious metals, so we get some type of nervousness to the marketplace, especially if it’s a geopolitical event, we could see Silver rebound rather quickly. Ultimately, I think the one thing you can count on is volatility but I believe that we are starting to see a significant selling off precious metals in general. These markets have been very difficult to navigate over the last several months, because quite frankly I think a lot of the problem is due to a lack of clarity when it comes to the Federal Reserve and its intentions going forward. While I do think that there are interest rate hikes and that of course is negative for precious metals, at the same time a lot of traders out there believe that the interest rate hike cycle will be somewhat limited.

SILVER Video 18.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement