Advertisement

Advertisement

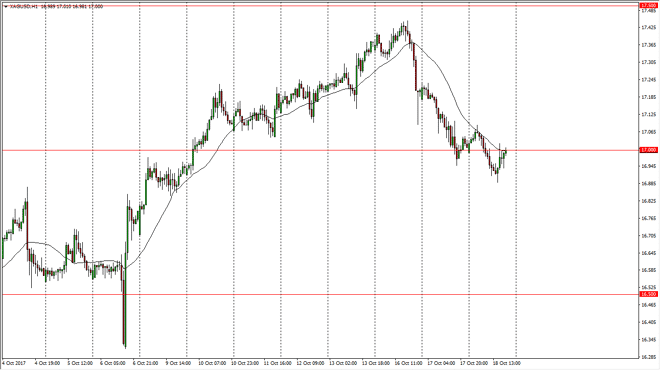

Silver Price Forecast October 19, 2017, Technical Analysis

Updated: Oct 19, 2017, 04:51 GMT+00:00

The Silver markets initially fell during the day on Wednesday, breaking below the $17 level. This is an area that of course will attract a lot of

The Silver markets initially fell during the day on Wednesday, breaking below the $17 level. This is an area that of course will attract a lot of attention due to the large, round, psychologically significant number. This is a 50% Fibonacci retracement level as well, so I think that it makes sense that the buyers will continue to jump into this market, especially if we can clear the $17.15 level. Ultimately, I think that once we get above there, the market will go looking towards the $17.50 level above which of course is massive resistance that we have seen recently. Ultimately, if we can break above the $17.50 level, the market should continue to go much higher, perhaps reaching towards the $18 level. This is a market that continues to be very noisy, because quite frankly the Silver markets are very thin at times, and that makes the market move rapidly.

I think that the market breaking below the $16.80 level should then send this market down to the $16.50 level next. I think in general we are essentially at “fair value”, and that should continue to be thought of as a bit of a magnet for trading. Once we break above this range, or for that matter below it, I think that the market offers you a reasonable trade for 24 hours or perhaps even 48 hours. I don’t know that we will break out of the overall one-dollar range that we are in, but if we do then it might be a situation where we can place a longer-term trade. Until then, I think that short-term back and forth type of trading that should continue to be the case, with $0.30 trades being what is being offered currently in this market.

SILVER Video 19.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement