Advertisement

Advertisement

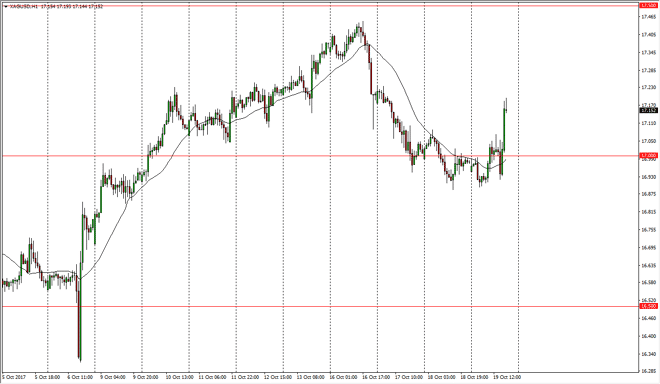

Silver Price Forecast October 20, 2017, Technical Analysis

Updated: Oct 20, 2017, 05:58 GMT+00:00

Silver markets initially went sideways, as we continued to hover around the $17 level. However, we then exploded to the upside, as we reached above the

Silver markets initially went sideways, as we continued to hover around the $17 level. However, we then exploded to the upside, as we reached above the $17.20 level. I think that the market will eventually go looking towards the $17.50 level, and a pullback should be buying opportunities. It’s obvious that the buyers have come back into the marketplace, and pushed silver higher. I think that the $16.80 level underneath should be the bottom of the uptrend that we have been experiencing on short-term charts, and a breakdown below there probably sends this market down to the $16.50 level. This is a market that of course reacts to risk appetite, and if it picks up I think that Silver may do as well. This is a bit of parabolic move though, so keep that in mind and we may need another headline risk or shock type situation to extend the rally.

If we were to break above the $17.50 level, the market could very well find itself breaking out for a longer-term move, which I think would at the very least go looking towards the $18 level above. This is a market that continues to see significant volatility, as Silver isn’t as liquid as gold. The 2 markets do tend to move hand-in-hand though, so keep an eye on the gold charts, if you’re going to trade this market as the positive correlation is rather strong. Also, pay attention to the US dollar, because if it starts to lose value that puts a little bit of a natural bid into the silver market as well. I think that if we did breakdown, the $16.50 level will be a very hard floor to break down through. Ultimately, this is a market that I like buying but recognize it is not the 80 only volatile at times.

SILVER Video 20.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement