Advertisement

Advertisement

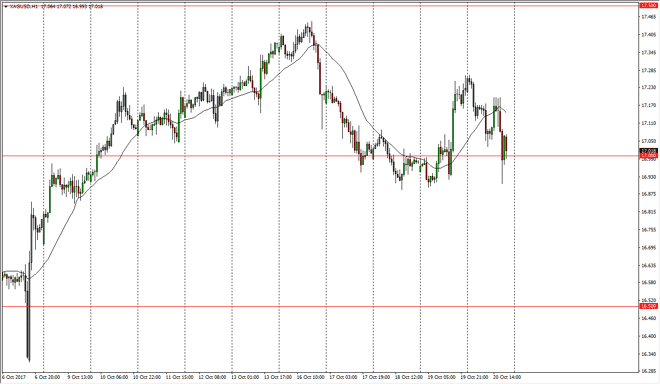

Silver Price Forecast October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:18 GMT+00:00

Silver markets fell rather significantly on Friday, as word got out that the next Federal Reserve Chairman in the United States could be very hawkish.

Silver markets fell rather significantly on Friday, as word got out that the next Federal Reserve Chairman in the United States could be very hawkish. Because of this, it tends to make the US dollar strength in, so it makes sense that precious metals took a bit of a hit. That being said, I believe it’s only a matter of time before the trading public test the $17 level significantly, and perhaps break down below there. However, we need to break down below the $16.85 level to start selling off. At that point, the market should then go down to the $16.50 level. That’s an area that should be rather supportive, and I believe the bottom of the overall consolidation area. The $17.50 level above is massive resistance, and I think at this point we are essentially at “fair value.” Ultimately, the market looks likely to cause a lot of headaches for traders to our overleveraged, so be careful about the market itself.

Ultimately, this is a market that will continue to struggle as the US dollar strengthens, but we will probably have a lot of headlines and out of the Federal Reserve and the entire process that should continue to smack this market in both directions. A breakdown below the $16.85 level is a short-term selling opportunity, and at this point I don’t have much in the way of interest as far as buying is concerned but I do concede that a break above the $17.30 level probably sends this market to the $17.50 level. Overall, I think that Silver is going to be a very dangerous market to be involved in, and more than likely very destructive to trading accounts around the world as we trying to garner some type of clarity with interest rates.

SILVER Video 23.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement