Advertisement

Advertisement

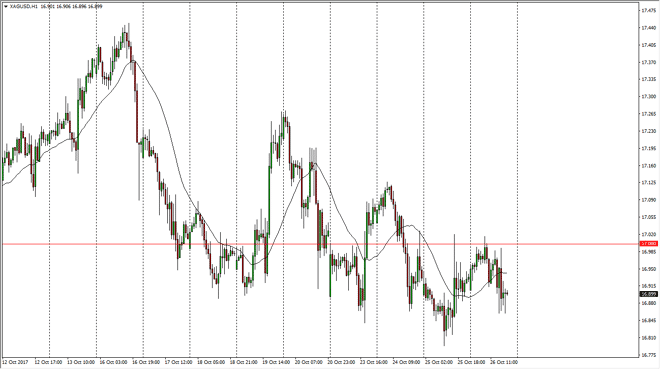

Silver Price Forecast October 27, 2017, Technical Analysis

Updated: Oct 27, 2017, 05:04 GMT+00:00

Silver markets initially rally during the day on Thursday but found the $17 level to be resistive. We rolled over from there, reaching down towards the

Silver markets initially rally during the day on Thursday but found the $17 level to be resistive. We rolled over from there, reaching down towards the $16.80 level, which has shown a bit of support in the past. If we can break down below the lows from the Wednesday session, I then think that the market drops to the $16.50 level underneath, which is the bottom of the overall consolidation that I think we are in right now. However, I think there’s more of a downward tilt to this market, so therefore think it’s probably easier to short this market on rallies than anything else. If we managed to break above the $17.15 level, then I think we may be free to go a bit higher, as it looks like we are forming a bit of a descending wedge.

At that point, I would anticipate that the market should then go to the $17.50 level next. That is the top of the overall consolidation area, and quite frankly I think that the $17 level is essentially the “fair value” for the market. I think that Silver will continue to be very noisy, and of course the market is typically volatile, so I prefer to play the silver market in alternate forms, not necessarily futures market. The CFD markets will give you the ability to choose your position size, which I would think should be small as we have no clear-cut move. The market also tends to follow the goal market, so pay attention to it as well, and of course the overall value and attitude of the US dollar will have its influence also. If the US dollar strengthens, that tends to work against the value of precious metals, so keep that in mind.

SILVER Video 27.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement