Advertisement

Advertisement

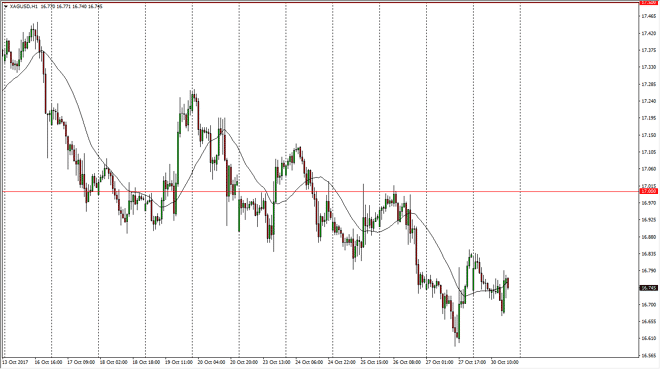

Silver Price Forecast October 31, 2017, Technical Analysis

Updated: Oct 31, 2017, 05:23 GMT+00:00

Silver markets fell during the trading session on Monday, reaching down towards the $16.70 level. We rallied from there though, and found enough support

Silver markets fell during the trading session on Monday, reaching down towards the $16.70 level. We rallied from there though, and found enough support to get some of the losses back. Ultimately, I think that the $17 level above should offer a bit of a ceiling though, and with the Federal Reserve looking to raise interest rates, I believe that the Silver markets are going to continue to have a bit of an overhang. It’s not until we break above the $17.15 level that I’m comfortable buying this market, and therefore I’m essentially looking for exhaustion to start selling. I will be the first to admit that we have made a “higher low” though, so there is the possibility that we are going to go higher. Having said that, I’m not going to go long until we break out to the upside.

I recognize that the $16.50 level underneath should be supportive, so if we can break down below there, the market should then go to the $16 level after that. Given enough time, it’s likely that we will try that, especially the Federal Reserve continues to make arguments to raise interest rates or if inflation picks up. Alternately, if we break above the $17.15 level, then I think the next major area of battle is the $17.50 level above. Overall, I am bearish, but I recognize that Silver tends to be extraordinarily volatile, and there will be times when the market explodes to the upside. Position sizing will be important, so I would not put too much into the market in one go. CFD markets or options can be a way to play the market, as it gives us an opportunity to cut downsizing or perhaps even mitigate risk or at the very least define it ahead of time.

SILVER Video 31.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement