Advertisement

Advertisement

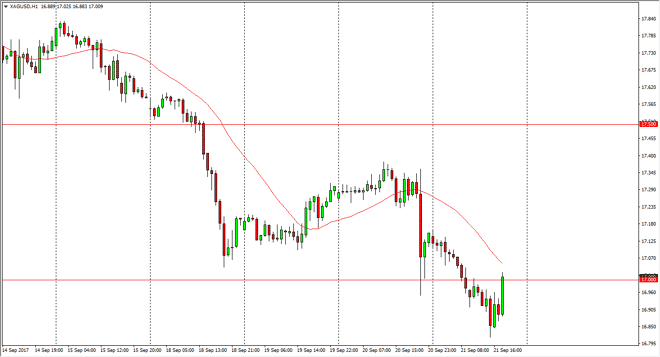

Silver Price Forecast September 22, 2017, Technical Analysis

Updated: Sep 22, 2017, 06:50 GMT+00:00

Silver markets fell again on Thursday, breaking below the $17 level. We have bounced since then but we are most decidedly in a downtrend over the last

Silver markets fell again on Thursday, breaking below the $17 level. We have bounced since then but we are most decidedly in a downtrend over the last several sessions. I think there could be more bearish pressure above, and quite frankly I’m not interested in trying to fight the market right now. I think that the Silver markets are probably best avoided because of the lack of stability at times, and this certainly looks like the recipe for volatility. I think that the US dollar could continue to strengthen overall due to the Federal Reserve’s shrinking of the balance sheet, and that could continue to put bearish pressure on precious metals overall, with of course Silver being a little bit less liquid than gold, so it causes more volatility.

In fact, I would not be against the idea of standing on the sidelines as this is a market that looks like it’s ready to cause problems. If we break down to a fresh, new low then I think that the market goes down to the $16.50 level. Alternately, if we break above the $17.30 level then we will almost certainly test the $17.50 level above which I expect to see a lot of resistance at. Quite frankly, this is a market that looks like it’s all over the place, and although we have more bearish pressure than bullish, sometimes it’s best to simply stay away from the markets as they are offering a great opportunity to lose money. I believe this is one of those times. Because of this, I am on the sidelines but I will keep you up-to-date as to what I’m doing in the silver market here at FX Empire, and will monitor the situation very closely over the next session or 2.

SILVER Video 22.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement