Advertisement

Advertisement

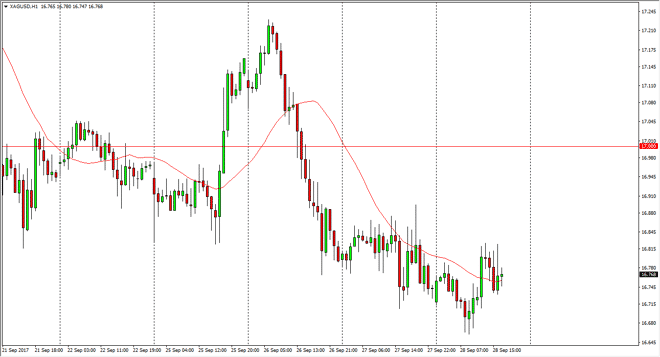

Silver Price Forecast September 29, 2017, Technical Analysis

Updated: Sep 29, 2017, 05:50 GMT+00:00

Silver markets went sideways initially on Thursday but then dipped to find support at the $16.65 level. We cents rallied a bit, but quite frankly still

Silver markets went sideways initially on Thursday but then dipped to find support at the $16.65 level. We cents rallied a bit, but quite frankly still have a large amount of resistance above. I believe that the $17 level will continue to keep the market on its back foot, so I’m not interested in buying quite yet. In fact, I would have to see a daily close above the $17 level to feel comfortable enough to start going long. The market continues to look volatile to say the least, and after the recent breakdown we have seen in the precious metals sector, it does not surprise me that we get a lot of back and forth. I think short-term traders have taken over this market, and longer-term traders that are bullish on silver are probably best served by either trading options, or building a physical stockpile of the metal. Quite frankly, when you trade this market with leverage, you’re playing with fire. Silver markets can be extraordinarily volatile at the drop of a hat.

Looking for resistance at $17

I think if you’re going to play the short-term charts, looking for resistance at the $17 level to start selling might be the best way to go. The market should find support at the $16.50 level though, so I think that it’s difficult to imagine a major breakdown, least in the short term. I believe that the market will continue to see volatility to say the least, as there has been a lot of noise coming from the Federal Reserve, which of course influences the US dollar, which of course influences precious metals. Pay attention to gold as well, as it tends to lead the way for silver as the 2 are positively correlated over the longer term.

SILVER Video 29.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement