Advertisement

Advertisement

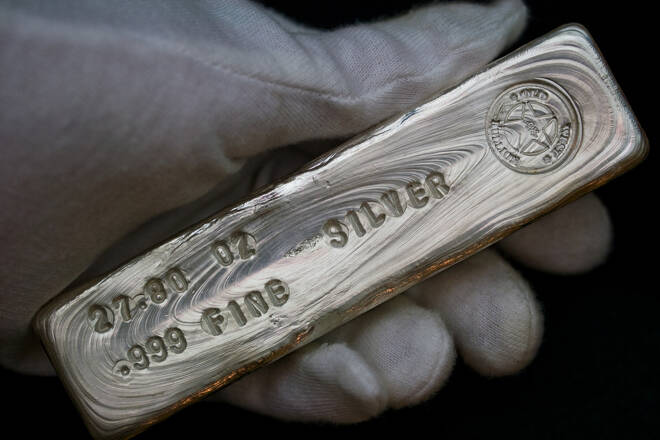

Silver Price Forecast – Silver Markets Slow Down

Published: Dec 2, 2021, 17:10 GMT+00:00

Silver markets have stabilized a bit during the trading session on Thursday, after what has been absolutely brutal selloff. At this point, a recovery is more likely than not.

Silver markets have been very quiet during the trading session on Thursday, as the selling pressure has finally abated. It should be noted that the market is awaiting the jobs number on Friday, so therefore it is likely that we will continue to see this market be very quiet until we get the number. At that point, the US dollar will jump around and that of course will move silver itself. Rallies at this point in time are what I am looking for, so that I can start shorting again. I do not think that we have hit the bottom, I simply think we have run out of momentum to the downside.

SILVER Video 03.12.21

I believe that the $23 level will be resistant, right along with the $23.75 level. The 50 day EMA is starting to slope down towards that level as well, so I think it makes quite a bit of sense that we would see that as a major “ceiling” in the market. If we break above there, then I think it could change quite a few things but right now silver simply does not look like it is ready to go anywhere. I believe that we will continue to see this market underperform, as even gold has tried to save itself.

Keep in mind that silver is much more volatile than gold, and much more sensitive to the US dollar. Furthermore, the silver market is also very sensitive to industrial demand, so that something that needs to be looked at as well. There are a lot of nervous traders out there due to the omicron deviation, thinking that the world is coming to an end, thereby killing the desire for industrial production. Obviously, that is overdone but there is clear trepidation.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement