Advertisement

Advertisement

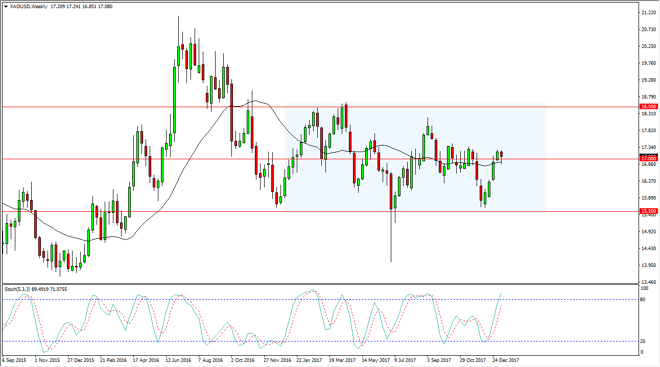

Silver Price forecast for the week of January 15, 2018, Technical Analysis

Updated: Jan 13, 2018, 03:06 GMT+00:00

Silver markets initially dipped during the week, but on Friday, we rallied significantly and broke above the $17 level. The resulting candle is very bullish.

Silver markets initially dipped during the week, but found enough buying pressure underneath to turn things around and form a hammer. The hammer of course is a very bullish sign, and it looks likely that we are getting ready to go higher, reaching towards the $17.50 level. The $18 level would be targeted after that, and eventually the $18.50 level. This is a market that has been consolidating for a couple of years in this general vicinity, and it looks as if we are ready to reach towards the top half of the area. If we can break above the $18.50 level, that would be a significant break out, but right now I think we are simply continuing the overall attitude of the markets, especially considering that the US dollar has been getting pummeled. That is good for precious metals overall, and thereby offers an opportunity.

Otherwise, if we were to break down below the bottom of the hammer for the week, that could send this market down to the $16.50 level, and then eventually the $16 level. I believe that we are going to continue to see interest in this market, and with the US dollar looking so very likely to fall, Silver markets will continue to benefit. Beyond that, all precious metals seem to be benefiting and it should be an overall rally in the commodity markets. If we can break above $18.50 level, then I think we go to the $20 level longer term. Alternately, if we break down below the $15.50 level, the market would be in serious trouble.

SILVER Video 15.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement