Advertisement

Advertisement

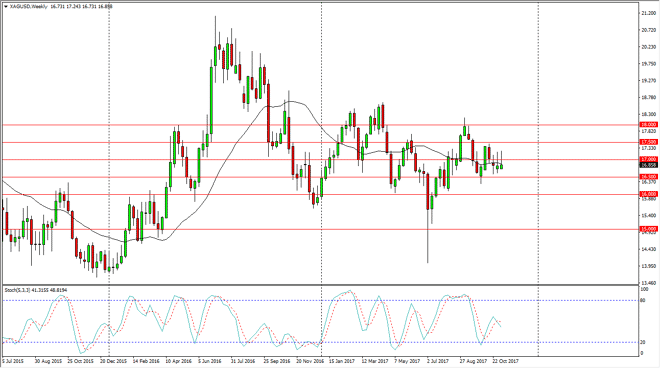

Silver Price forecast for the week of November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:11 GMT+00:00

Silver markets initially tried to rally during the week, breaking well above the $17 handle before retreating. By doing so, the market ended up forming a

Silver markets initially tried to rally during the week, breaking well above the $17 handle before retreating. By doing so, the market ended up forming a shooting star, which it had done the previous week. This is a very negative sign, but I also see a significant amount of support at the $16.50 level, and it may take a while to break down below there. If we do, then the market should go down to the $16 handle underneath. That’s an area that will be even more supportive, but a break below that level opens the door to the $15 level. Alternately, if we were to break above the top of the shooting star from the past couple of weeks, that has the market challenging the $17.50 level, and then perhaps reaching towards the $18 level.

In other words, the market is far too tight to have this market looking like one that you can trade from a very long-term picture, unless of course you are willing to hold physical silver which is an entirely different investment altogether. I think with the chart tells us is that it’s going to be very choppy over the next several weeks, if not months, so therefore longer-term traders need to look at this chart incrementally, and perhaps in $0.50 sanctions. In very obviously has reaction every time we hit one of those levels, so pay attention. All things being equal though, it looks as if the downside is probably favored for the next move, and perhaps the rest of the year. Overall, it’s a market that should continue to be noisy, but silver always is so if you have traded different in length of time you should be used to this.

SILVER Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement